This week, we saw back-to-back rallies with huge up days on Monday and Tuesday. But since then, the market has been a little shaky as it continues to digest the fate of rates, challenges overseas, and Q3 earnings and projections going forward. The fact of the matter is nothing has really changed since last week that would have warranted such a huge two-day bounce. We are still in a Fed tightening cycle, China is still in lockdown mode, recession fears loom, and the war is still ongoing. Even the UK has introduced new challenges for the market to contemplate. So, in a way, that two-day bounce was simply a “head fake” and unfortunately, we should continue to expect to see more volatility and more choppy days ahead.

Also this week we got news out of OPEC who cut production by 2 million barrels a day. The Energy sector has been trading up on the news. That sector has been a nice winner for us in the models this year.

Aside from head fakes and OPEC cuts, many of the same themes that have challenged the markets this year are still out there and continue to keep investors concerned. To name a few:

- Inflation is #1 and the Fed has only begun to address it. It will take time for inflation to come down and may take longer than people think.

- Can the Fed engineer a soft landing? Or will it be a hard landing? How will the markets react in either scenario?

- How will jobs settle in? The Fed is trying to slow the labor market down but according to the latest JOLTS report released on Tuesday, vacancies remain above 10 million for the 14th straight month. However, some cooling is beginning to show as job openings fell the most in nearly 2 ½ years. The question is will this trend continue?

- Will the supply chain work itself out? How long will that take?

- How will Q3 earnings look? Projected guidance? Are inventories moving?

So where does this all leave us as we begin October and head into year-end? The answer is simple: there is a lot of uncertainty out there right now. Therefore, from an asset allocation perspective, stay the course with a defensive theme, be conservative, and focus on quality. Invest in brands and companies that can weather an inflationary environment. In equities, focus on defensive sectors like healthcare, utilities, telecom, and staples. Focus on companies with strong balance sheets, loads of cash, low debt/equity, and pay a stable dividend over time. In fixed income, invest in higher quality bonds, keep duration low, and shift to a point on the yield curve that makes sense as yields continue to rise. Perhaps use a laddering strategy. This is exactly what we are doing in the GVA models and next week, we will reset all of our model weights to these exact themes with our Q4 rebalance.

At a higher level, here is a nice article by SPDR funds that outlines five key talking points on the markets at this time. Note they expect choppy days to continue as well, although wider sector dispersion does present opportunity. Which is what we are trying to take advantage of in the models by overweighting sectors that have the momentum right now. Like energy.

The point here is nothing has really changed in the macro environment at this time. Yet we saw that head fake from the market on Monday and Tuesday. As we do in sports, don’t let the head fake shake you from your defensive position and don’t let the market run by you. Hold your spot on the court!

Enjoy the weekend and hopefully if you are on the east coast, you’ll get to enjoy some sun this weekend now that all the rain from Ian has passed. And for those in the Florida region we all hope you are doing well down there.

Take care!

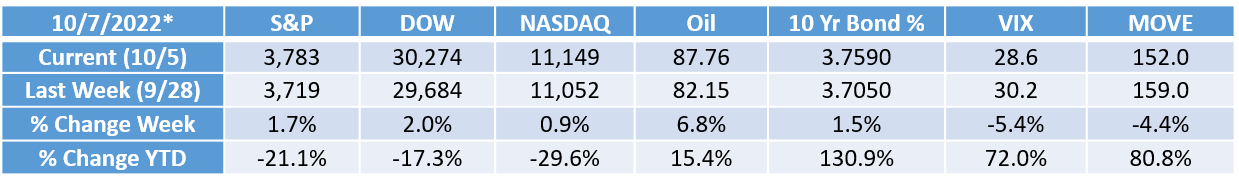

*All data sourced from Yahoo Finance as of the close on the date indicated

Disclosure

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Asset allocation does not ensure a profit or protect against a loss. All investing involves risk including loss of principal. No strategy assures success or protects against loss.

Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Tracking# 1-05335896