The outlook is strong for asset allocation portfolios heading into the second half of 2023. From a broad diversification perspective, markets are providing good reasons for optimism across the key asset class spectrum. Of course, the outlook is not without risks that must also be considered.

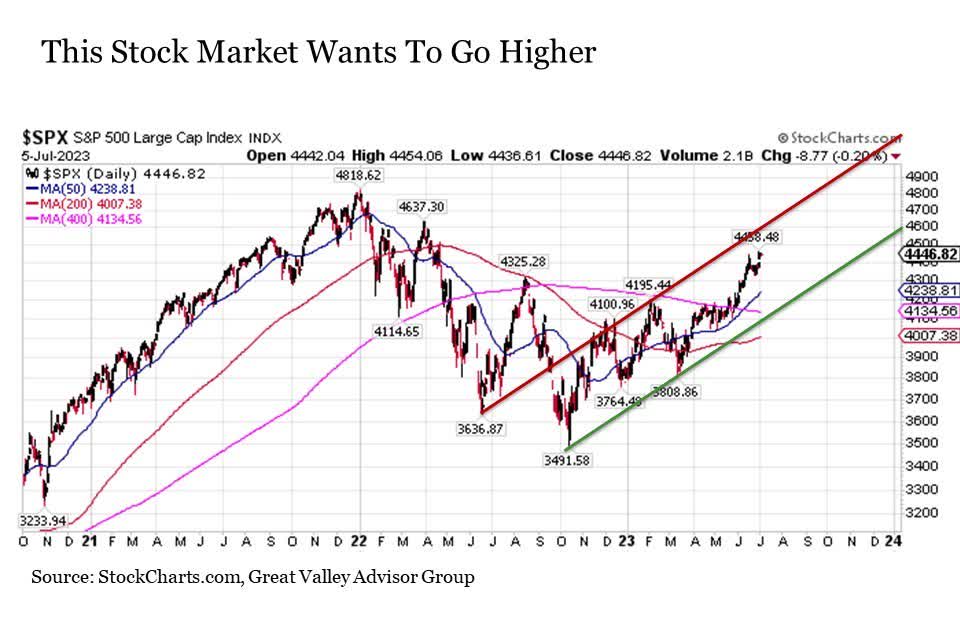

Stocks. The trend for stocks as measured by the S&P 500 is definitively to the upside as we pass the halfway point in 2023. Moving in a trading channel that first began to form roughly a year ago, U.S. stocks have been moving increasingly more decisively to the upside since bottoming last October.

A variety of fundamental factors support stocks continuing to the upside through the rest of the year. This includes consistently fading inflation pressures, resilient economic strength in the face of persistent recession expectations, a still strong housing market with favorable supply/demand characteristics, steadily declining high yield bond spreads, reaccelerating corporate profits, and corporate profit margins that have started to widen again.

Putting all of this together and if stocks continue to move in their current upward sloping channel, it implies an S&P 500 Index that is on track to potentially trade at new all-time highs by the end of 2023. With that said, investors should also be prepared for extended periods of consolidation along the way in traveling this upward sloping path. For example, the S&P 500 could retreat by -6% or more from current levels toward 4200 and the uptrend would still be very much intact.

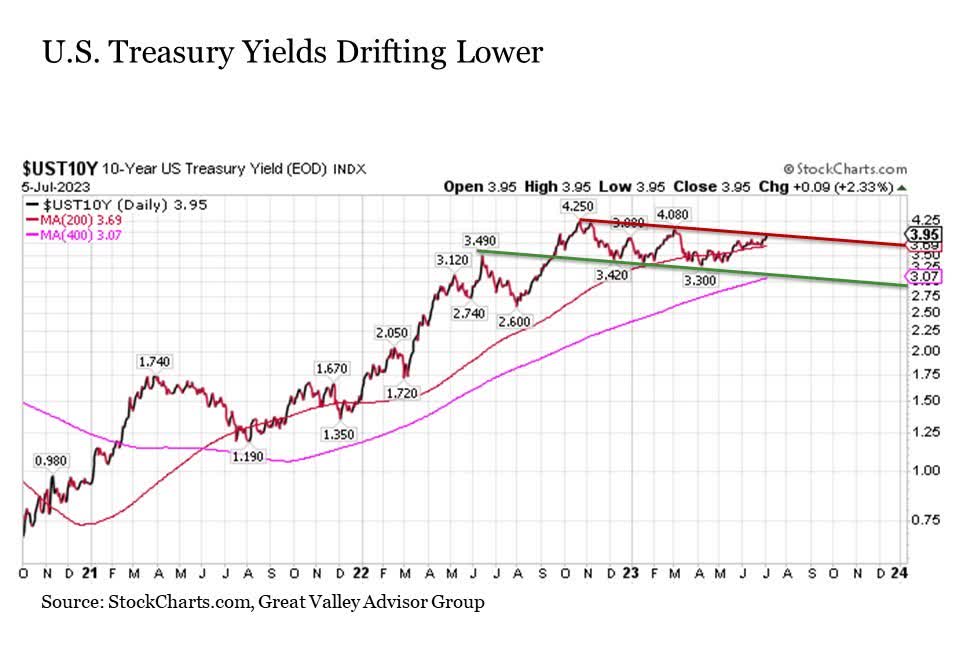

Bonds. While stocks and bonds are often noted for their tendency to move in different directions at any given point in time, the outlook is also favorable for bonds in general and Treasuries in particular as we enter the second half of the year.

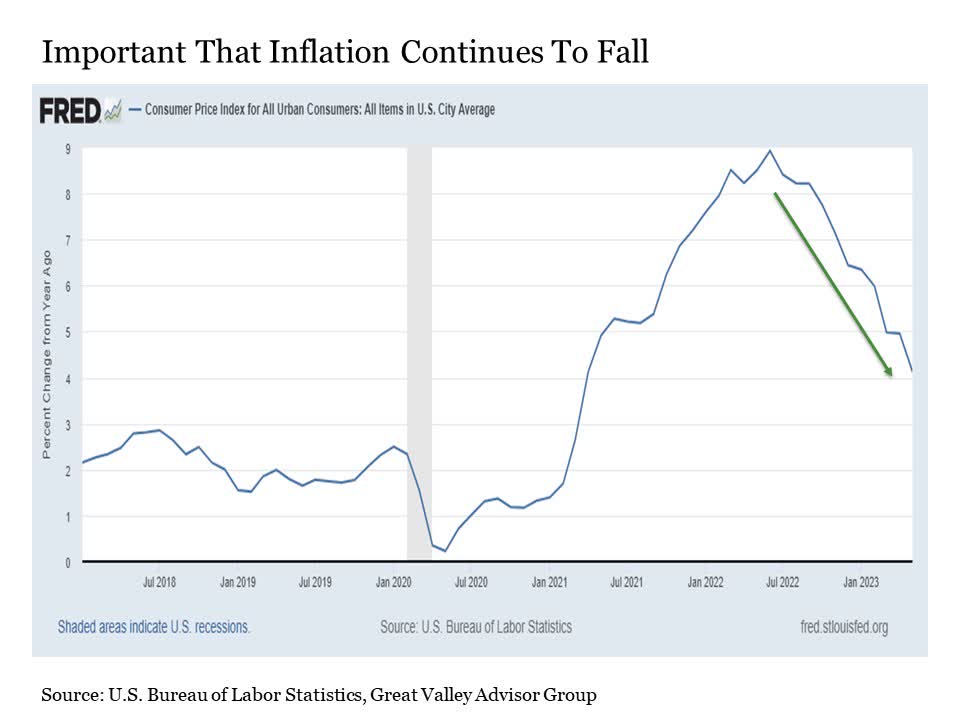

Why Treasuries? While several factors impact bond prices at any given point in time, inflation is the primary determinant of Treasury bond returns. And the longer the duration of the Treasury securities, the more pronounced the impact of inflation is likely to be on the bond price. Thus, with inflationary pressures continuing to fade both on a headline and core basis dating back to mid- to late 2022, this is creating an increasing tailwind for lower Treasury bond yields and higher prices.

Not long after the core inflation rate peaked last September, the 10-Year U.S. Treasury yield also peaked. And in the nine months since, Treasury yields have drifted steadily lower. And while bond yields moved higher over the course of 2023 Q2, they start the second half of the year at the very top of their trading range on the 10-Year U.S. Treasury. As a result, it would not be a surprise to see the 10-Year Treasury yield fall toward the mid to low 3% range over the course of the third quarter and possibly back below 3% by the end of 2023, as both outcomes would fall within the current trading channel whose foundation dates back over the past year.

What would drive Treasury yields lower in the coming months? In addition to a continued decline in inflation, concerns about the economic outlook and the threat of a recession is likely to resurface at some point along the way as we move through the second half of the year. And given that Treasuries remain the global destination for capital seeking safe haven, such forces would likely move yields to the bottom end of the trading channel in a hurry.

Gold. The yellow metal is also set up well to have a favorable second half of the year. Gold is widely regarded as an inflation hedge, which raises questions around why we should expect it to perform well if inflation is steadily falling. But the reality is that gold is much more a hedge against economic uncertainty and potential instability than inflation. This is particularly true since any benefit for gold from higher inflation is likely to be more than offset by a Federal Reserve that will move to tighten monetary policy aggressively to fight said inflation, thus draining the liquidity from capital markets that is the lifeblood of moving the gold price higher. Thus, the fact that the Fed is hawkishly pausing on raising interest rates further at a time when inflation continues to fall and ongoing threats to the economic and geopolitical outlook abound provides a favorable backdrop for gold to hold up well in the second half.

In order to assess the upside opportunity set for gold going forward, it is worthwhile to draw far back from the 2023 tree and look at the more than decade long forest. Gold has been in a sustained uptrend dating all the way back to the Great Financial Crisis. The gold price got waaaay ahead of itself by 2011 and spent the first half of the last decade consolidating back to upward sloping trendline support. And since the end of 2015, gold has been moving steadily higher along this upward sloping trend line support.

Where do we stand today with the gold price? It should not be ruled out that gold could retreat all the way back below $1,700 per ounce in the coming months, and the uptrend in gold would remain intact. If this trendline support continues higher through the remainder of 2023 and into 2024 as expected, pressure would continue to be applied against gold price resistance in the $2,080 per ounce range to eventually push the gold price to the upside through this level.

Cash. Another favorable advantage in the current market environment, particularly for risk averse investors, is the fact that for the first time since what seems like the Van Buren administration (actually the GW Bush administration), investors are being paid an attractive interest rate north of 5% for holding their cash in short-term instruments like money market mutual fund accounts. And with a Federal Reserve lining up for another quarter point hike in July and maybe squeezing out even one more 25 bps move before the end of the year, investors are set to continue to get paid a decent yield for effectively hanging out on the sidelines.

So as we ride into the second half of 2023, the good news for investors is that the four main horses pulling the asset allocation wagon are moving into stride.

Of course, investors are not without discernable and very real risks that could readily derail this otherwise bullish capital market outlook.

Inflation reversal. The most significant risk confronting investors as we move into the second half of the year is the threat of a renewed surge in inflation. The good news so far this year has been a much stronger than expected economy. Good news, right? That is, of course, as long as the economy does not prove too strong that it starts to put upward pressure on prices.

For if instead of continuing to come down the other side of the inflation mountain, if we start to turn back higher to a new peak, then all bets are off across all asset classes. The downside would likely be particularly pronounced for stocks under this scenario for the following second risk on the list.

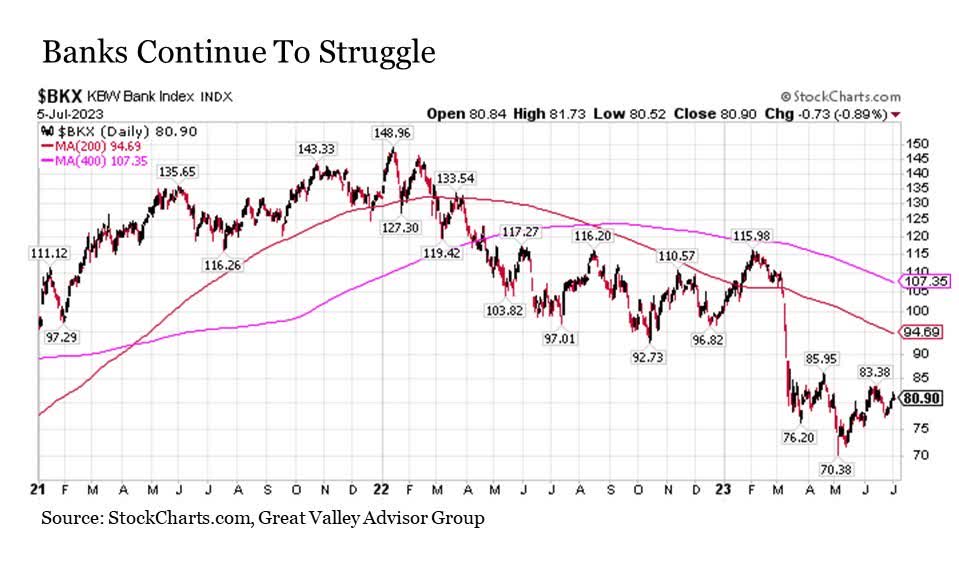

Bank crisis. Although it seems like a distant market memory, it was less than four months ago in mid-March when we stood on the brink looking down into the latest financial crisis rabbit hole. But while swift emergency measures from the U.S. Treasury, the Federal Reserve, the FDIC, and even the Swiss National Bank (nothing like spending a late winter weekend holding your breath hoping a bunch of policy makers on the other side of the planet are going to save our collective portfolio bacon) managed to salve the wounds, the underlying problem has not gone away. At all.

A simple way to highlight the fact that many small and mid-sized banks (and some really big ones like Bank of America to a certain degree too) continue to hang by a string is to consider the KBW Bank Index. For while the U.S. stock market in general continues to surge to the upside, the regional bank index is still languishing at levels where it first descended when Silicon Valley Bank and Signature Bank quickly evaporated into the financial ether. If we enter another round of bank failures in the fall, this would be bad for stocks, but good for bonds, gold, and cash.

This brings us to the potential one-two punch. Banks may be hanging on as we move through the summer and inflation continues to fall, but if we see a renewed rise in inflation that forces the Fed to start raising interest rates aggressively even further, such an outcome would likely be more than enough to push a whole set of teetering banks over the edge. And depending on the number of banks that succumb, this could not only drive the economy into a full blown recession but also start to pressure overall financial stability. This is a one-two to watch as we move through the second half of the year.

It should be noted that neither or both of these downside risk scenarios are my base case, but a sufficiently meaningful probability can be assigned to these outcomes that they warrant close monitoring in the months ahead.

Bottom line. The outlook for risk assets as well as safe haven assets across the capital market spectrum appears strong as we enter the second half of the year. Seek to capitalize while keeping measured expectations, recognizing that periods of consolidation are likely along the way, and monitor what are still meaningful downside risks.

Disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #:454058-1