It has been a November to remember. Following a three-month slide from August to October that saw U.S. stocks decline by more than -10% and the 10-Year U.S. Treasury yield jump by more than a percentage point (ouch and ouch), capital markets roared back to life this month. Overall, the S&P 500 posted its third best monthly return for November in history – only 1935 and 1998 were better – and the 10-Year U.S. Treasury yield has come back down by three quarters of a percentage point from recent highs to the 4.25% range. With such a furious rally over such a short period of time, it is reasonable to wonder if investors have missed their chance to participate in the rally. The good news is that the stock market is still filled with upside opportunities as we head into the final month of the year.

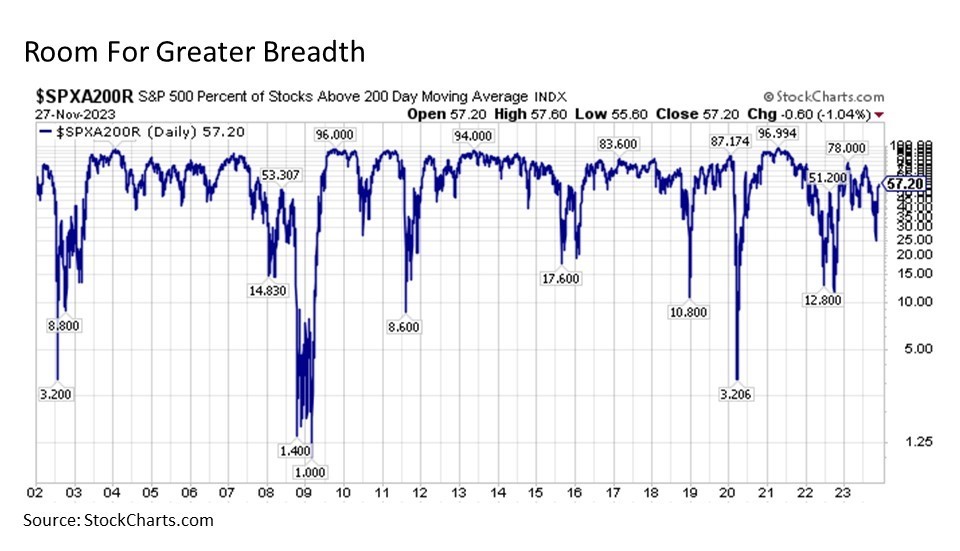

Room for broader participation. Yes, the rally in U.S. stocks has been strong in November, but it’s also worth highlight that participation in the rally has been somewhat concentrated so far. Whereas we normally see upwards of 80% of stocks in the S&P 500 move above their 200-day moving averages during a major market rebound, to date only 57% of stocks in the Index have climbed back above this key resistance level.

Now the pessimist might view this as a downside risk under the notion that if the stocks leading the rally falter, the rest of the stocks in the market that are already weak are not going to be able to pick up the slack. And in many market environments, I might be inclined to agree with this notion.

But today I am inclined toward a more optimistic view, particularly in an environment of generally stable and to date stronger than expected economic growth coupled with falling Treasury yields, fading inflationary pressures and a Federal Reserve that is likely done with hiking interest rates in the current cycle.

So although only a subset of stocks have been driving the rally to date, the opportunity exists to see broader market participation including among those stocks that have not fully lifted thus far playing catch up to the upside. And where are these opportunities most abundantly found? Among mid-cap and small cap stocks.

Balancing the scales. The first place to find such opportunities is within the S&P 500 Index itself. The S&P 500 is a market cap weighted index, so that the mega huge stocks that make up the so called Magnificent Seven – Apple, Microsoft, Amazon, Alphabet, Meta Platforms, NVIDIA, and Tesla – make up nearly 29% of an Index that also includes 496 other stocks (yes, the S&P 500 Index has 503 stocks – go figure – we can blame Alphabet (nee Google) among others for this anomaly). And since these mega stocks have done mega well so far in 2023, they have driven the overall S&P 500 higher in a year where the rest of the market has been varying degrees of meh.

So while the S&P 500 Equal Weighted index where all stocks in the Index have the same 0.2% allocation has kept pace with the headline benchmark S&P 500 Index for the month of November, we can see from the chart above that there is still a lot of room for the rest of the stocks in the S&P 500 to catch up to the biggest names in the Index going forward.

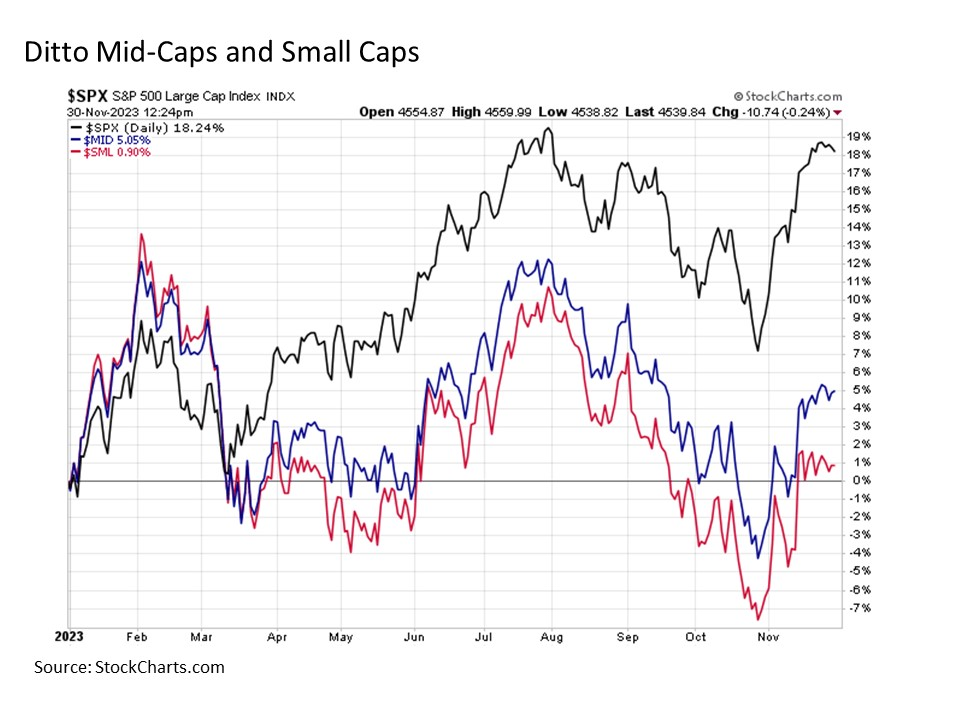

All things mid and small. We see the same phenomenon playing out among mid-cap and small cap stocks in the U.S.

Much like the S&P 500 Equal Weighted index, both U.S mid-caps and U.S. small caps as measured by the S&P 400 Mid-Cap and S&P 600 Small Cap indices, respectively, have meaningfully trailed the headline S&P 500 for the year to date so far. As a result, these market segments have meaningful room to catch up to the upside.

Why now? The natural question to consider when thinking about potential opportunities smaller large caps, mid-caps, and small caps is understandable. If the S&P 500 Index driven largely by seven “magnificent” monsters have been driving the market higher for so long to date, why should we expect this to change going forward? In short, what is the catalyst?

To be certain, I’m not suggesting that investors spurn the mega caps when considering investment opportunities in the smaller size segments of the equity market. Instead, to quote the closing scene from arguably one of the greatest movies about trading frozen concentrated orange juice of all-time, “can’t we have both?”. Indeed we can in the context of building an asset allocation strategy – lobster and cracked crab as well as a variety of other surf and turf and some wholesome starches and vegetables to boot as part of a well balanced portfolio construction diet.

And when it comes to why these smaller segments of the market may be poised to catch up to the headline index going forward, several reasons lead the list. The following are just a few.

First, both relative and absolute valuations have become increasingly attractive across these smaller sized market segments. For while equal weighted S&P 500 Index is trading at its most attractive multiples since the late 2010s, both mid-caps and small caps are now trading at deeply discounted valuations last seen in the early 1990s.

Also, after more than a decade following the Great Financial Crisis where interest rates were pinned at 0% and monetary policy liquidity was gushing into the market, still nervous investors that needed to do something with this excess capital would frequently direct it to the most reliable free cash flow generators, regardless of the price (after all, when your risk free rate is 0%, your market valuation models can start to go bonkers). But now, following the inflation fever of 2021-2023, the Fed funds rate is now well off the ground at over 5%, and we are likely finally back in a normal monetary policy environment after so many years (in other words, the free money spigot has FINALLY been shut off, and none too soon!). In such an environment, valuations matter more and investors will likely need to work harder and dig deeper to find outperforming total return opportunities in stocks going forward. Such opportunities are most often found in mid-caps and small caps.

Bottom line. It’s been a November for the ages in 2023 for capital markets. And while investors may be left wondering if they’ve already missed the upside run as the calendar flips to December, the good news is that upside opportunities are still widespread and abundant across capital markets including with the U.S. stock market.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking – #511313-1