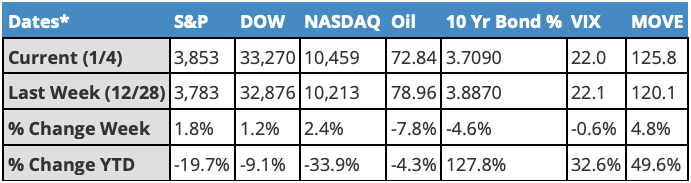

As we begin the new year, it’s only fitting to take a step back and reflect on what was and what is to be. Well, we all know how 2022 played out and it was quite frankly an unprecedented year in both the equity and bond markets as both trended down pretty hard all year. Equity losses were the highest since 2008, with the S&P 500 finishing down 19%. Meanwhile, the Barclays Agg posted the worst year on record since it began over 45 years ago in 1976, down 13%. Quite simply, there was no place to hide. And all of this happened during the fastest pace of rate tightening in recent history. So I would say it’s pretty fair to say “we are where we are” at the moment.

So what should we expect at this point? We should expect a transitional period right now with some bumpy periods to stat the year out here. Mostly driven by a slowing economy and a natural progression to an earnings decline. At least in the first quarter and perhaps into mid-year. Obviously driven by the high-rate environment we are experiencing right now. And of course, driven a lot by what the Fed does with rates. The good news, though, is we are closer to rates steadying at least during the year than continuing to go up. But if we take a step back here and simply look at the end-all metric of market valuation in the P/E ratio and think of fair value as typically 16-17 P/E and also consider the forward 12 months earnings is currently being estimated between 225 and 230, then that implies a pretty flat to down market in 2023 ranging from -5% to +5%. A lot can change between now and then, but this is what the numbers are telling us at this point. This is simply pointing to another challenging period as we start the year here. Especially with a potential recession looming. Which many popular indicators are pointing to as well (leading economic indicators, 3 month/ 10 yr treasury spread, PMI, even the index of consumer sentiment at its lowest level since the late 70s, etc). However, the PMI report had several statements on improvements in the supply-chain issues that have plagued the manufacturing sector over the past few years so perhaps there is some silver lining there.

And then what do we do about it? Well, we should expect defensive sectors to continue to hold up relatively better than the broader market. Which is how we’ve been positioned for a while as we’ve stayed defensive and focused on quality all year. I think it’s also important to point out a famous Benjamin Graham quote that says: “The essence of investment management is the management of risks, not the management of returns.” This simply captures the essence of the moment right now, i.e. “We Are Where We Are”. So, with that, we really tried to focus on the risk profile of the models this year and made sure correlations were as low as possible across all asset classes. And in our latest year-end rebalance we improved on that by doing four sets of trades to help improve the risk aspect on the models: 1) we trimmed energy exposure for healthcare, 2) sold out of high yield for intermediate term treasuries, 3) swapped out of hedged equity exposure for dividends and quality fixed income, and 4) sold out of metals and mining in exchange for quality core bond. For example, in the GVA Balanced model, the beta against the S&P 500 went from 0.69 to 0.54. That’s the idea and these trades fully encompass what we have been doing all year. And certainly indicate we are staying in that “risk off” mode right now.

Looking further out to 2024 and possibly as early as the second half of 2023, we might begin to see cyclical sectors rebound as the market starts looking forward to an economic recovery. With that in mind, we would begin to favor asset classes and sectors that favor a lower inflationary environment (we hope and pray!) like consumer discretionary and industrials. We should also expect interest rates to peak at some point in 2023 and that will certainly lead to relief in the markets. Speaking of relief, this market is pretty much setting up for a classic bear market recovery but it’s important to stay on the right side of the risk on/risk off trade right now. Which we are pretty much risk off right now. But there will be a time to shift back.

The new year brings us full circle to a new beginning. But it also reminds us to reflect on where we were. In a way, if you look back to Covid, we were technically in a liquidity fed bull market that is now reversing itself in a true classic pattern to a bear market as all that liquidity fed inflation drains itself out. But it’s a symmetry that might reverse itself in 2023. Or at least begin the makings of it. From our perspective at GVA Asset Management, we will continue to remain steadfast in the objectives we have set out for ourselves to navigate that possible scenario. By engaging each another in a spirited, collaborative way to make meaningful decisions in the models.

“We are where we are” BUT – more importantly – “we were where we were”. And that’s the beauty of looking ahead to better days. Here’s to recovery and reversal!

Thanks for reading and have a great weekend.

*all data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Compliance Tracking #: 1-05355076