Summary

- Developed international and emerging market stocks have been surging relative to the U.S. in recent months.

- Are non-U.S. stocks finally ready to take the sustained lead over their U.S. counterparts?

- A closer look reveals that non-U.S. stock performance may not be as impressive as it seems at first glance.

Non-U.S. stocks have been on fire as of late. After years of chronic underperformance relative to the United States, both developed international and emerging market stocks have been strongly outperforming over the last few months. This recent development raises a worthwhile question – have we finally arrived at the point where non-U.S. markets are ready to take the sustained lead over their U.S. counterparts?

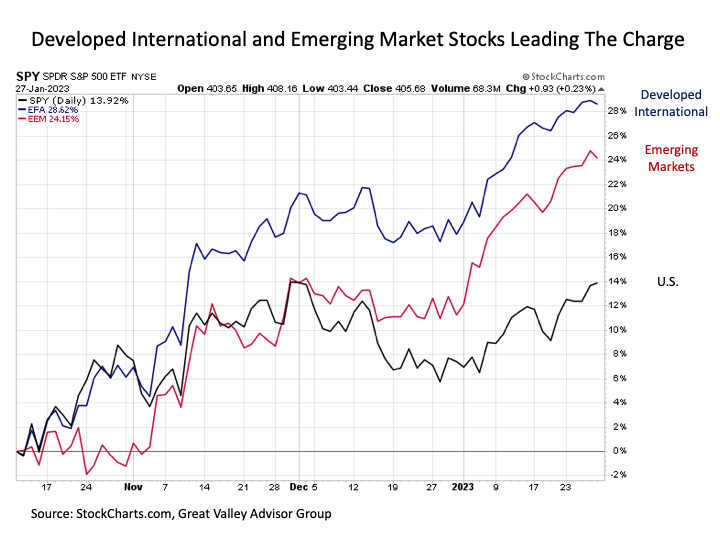

New leaders. The magnitude of the recent performance differential has been notable. Since the mid-October lows across global stock markets, developed international stocks have advanced by more than +28%, while emerging market stocks have added an impressive +24%. This represents double-digit outperformance versus U.S. stocks that have gained less than +14% over this same time period.

Time to study abroad. The notion that this recent outperformance might be the beginning of a geographic rotation out of U.S. stocks and into non-U.S. stocks would not be without merit.

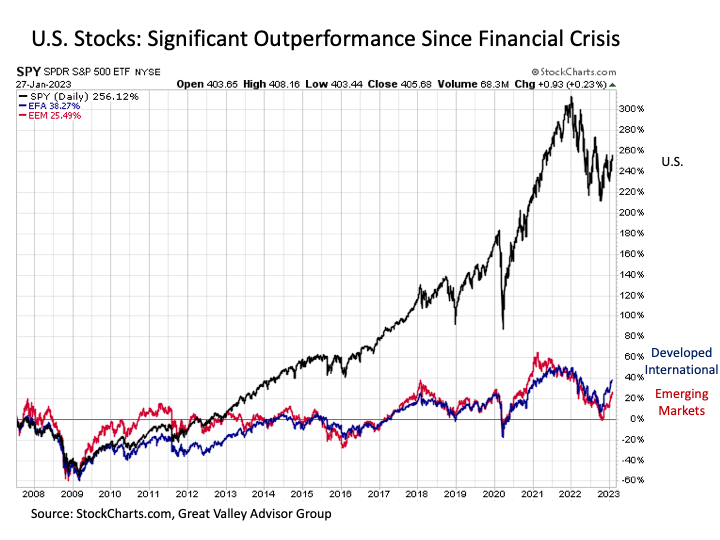

Consider, for example, that over the past 15 years since the onset of the Great Financial Crisis back in the summer of 2007, U.S. stocks have generated a cumulative total return of more than +250%, while both developed international and emerging market stocks were close to flat over this same time period as recently as a few months ago. That’s fifteen years where stocks outside of the U.S. have effectively gone nowhere (and are measurably lower on a real return basis) at a time when U.S. stocks have soared into the stratosphere. By this measure, such a rotation out of the U.S. and into non-U.S. would be long overdue.

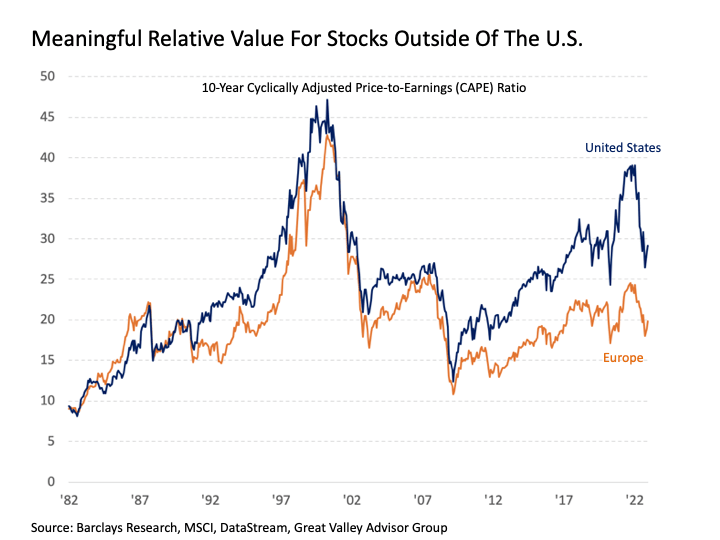

Stocks outside of the U.S. also offer a meaningful relative value versus U.S. stocks. As a case in point, the 10-year cyclically adjusted price-to-earnings (CAPE) ratios between the United States and Europe have historically tracked very closely to one another. But since the bottom of the Great Financial Crisis in early 2009, the U.S. and Europe began to deviate measurably on a CAPE valuation basis. Today, the valuation disparity remains meaningful, as U.S. stocks are trading at a CAPE north of 27 while Europe stocks are trading at a CAPE of just 19. In short, two markets that once historically shared virtually the same long-term valuations now see U.S. stocks trading at a near 50% premium. By this measure, either Europe stocks eventually have a lot of room to catch up to the upside, or U.S. stocks eventually have a lot of room to fall to the downside. Either way, Europe stocks would be overdue to meaningfully outperform by this comparative measure.

Upon further research. While the recent relative outperformance of non-U.S. stocks appears impressive and notable on the surface, its meaning quickly starts to crumble upon further investigation.

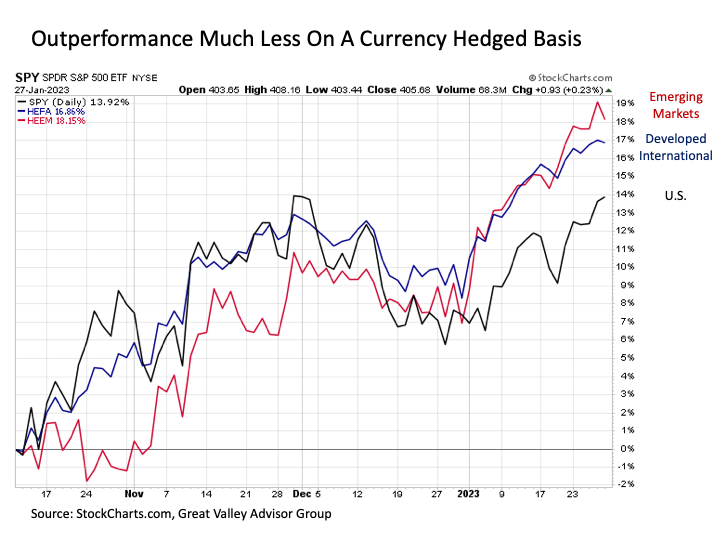

First, let’s consider the role that currency effects are playing in this recent non-U.S. total returns leadership. To neutralize any potential currency effects, we will consider the cumulative total returns on a currency hedged basis for developed international and emerging markets.

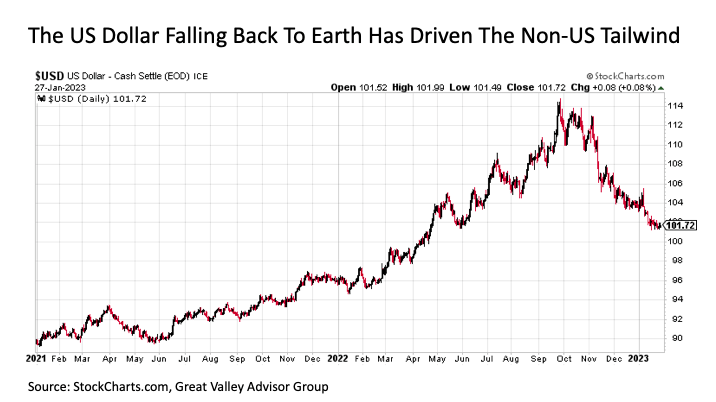

While developed international and emerging markets are still leading on a currency hedged basis, the relative outperformance is meaningfully less. If anything, returns performance across the globe starts to look more like a rising tide lifting all boats than non-U.S. markets assuming any sort of sustained leadership role. After all, emerging market stocks were trailing on a currency hedged basis through early December, and if one were to eliminate the burst to the upside in non-U.S. stocks in the first trading week in January, U.S. stocks would actually be outperforming since mid-October on a currency hedged basis.

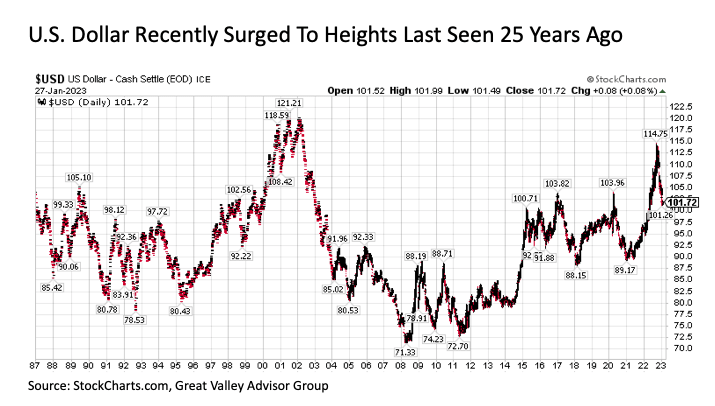

In this context, it is worthwhile to examine the path of the U.S. dollar over the last several months. Over the first ten months of 2022, the U.S. dollar surged to levels reached only once before (during the tech bubble in the early 2000s) since the advent of the “Fed put” roughly 35 years ago now in 1987.

This U.S. dollar strengthening was driven in large part by the rapid increase in interest rates by the U.S. Federal Reserve to combat the worst inflation outbreak in this country in more than four decades. But once the market shifted its focus to the notion that the Fed may soon stop raising interest rates and may actually start cutting rates at the end of 2023, the U.S. dollar quickly lost its verve, falling by more than -12% from October highs.

Now that the U.S. dollar has fallen from historical highs to not far above the long-term historical average, how much further can we expect the weakening U.S. dollar to offer a tailwind to non-U.S. stock returns? If nothing else, a good deal of juice is already likely out of the weakening U.S. dollar orange. And if economies across many parts of the world officially fall into recession as anticipated in 2023, it leaves open the possibility for safe haven rallies back into the U.S. dollar in the months ahead.

But what about the ability of non-U.S. stocks to assume the leadership mantle based on the fundamentals? From a relative economic growth standpoint, the case is less than compelling. Europe continues to grapple with many of the same economic challenges confronting the U.S. while also coping with a massively challenging energy market environment and the ongoing spillover effects of the war in neighboring Ukraine. The challenges confronting the United Kingdom are particularly acute. While growth prospects in the Asian Pacific are arguably better than Europe, they are not sufficiently or consistently so that it would catalyze the start of a sustained period of relative outperformance versus the U.S. As for emerging markets, while the China economic reopening may provide a short-term tailwind, it is at least partially counterbalanced by the ongoing fiscal challenges confronting a number of indebted sovereign countries across the world that continue to struggle with high interest rates, inflation, and slowing economic growth.

Bottom line. While developed international and emerging market stocks have posted rousing outperformance versus the U.S. in recent months, investors should proceed with caution in potentially reading too much into this situation. While the magnitude of the performance differential looks impressive at first glance, most of the outperformance was driven by the precipitous weakening of the U.S. dollar and not necessarily anything fundamental or sustainable for that matter.

As a result, investors are likely well served to stay the course with their current allocations and not rush to meaningfully add developed international or emerging markets based on any signals from recent outperformance.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. Great Valley Advisor Group and Stonebridge Wealth Management are separate entities.

This is not intended to be used as tax or legal advice. Please consult a tax or legal professional for specific information and advice. Third party posts found on this profile do not reflect the views of GVA and have not been reviewed by GVA as to accuracy or completeness.