Summary

- The U.S. banking system is caught in a major storm and the flood waters continue to rise.

- How much is the banking system at risk going forward?

- What are the implications for the broader economic and financial markets?

If it keeps on rainin’. It was nearly a century ago when the Great Mississippi Flood resulted in one of the most destructive and costly natural disasters in U.S. history. One wonders whether another flood is threatening to break across the U.S. banking system and the broader economy today.

Mean old levee. Over the last two months, we’ve seen the failure of three of the 35 largest banks in the U.S. as measured by total assets – First Republic (#15), Silicon Valley Bank (#17) and Signature Bank (#32). Combined, these three institutions represented over $530 billion in total assets, or 2.3% of the entire U.S. banking system. And this doesn’t include the dissolution of Swiss banking giant Credit Suisse along the way as well.

So how have we arrived at this critical stage for U.S. banks? The U.S. Federal Reserve for years since the Great Financial Crisis built a figurative levee for the banking system by providing boundless amounts of liquidity and chronically low interest rates. Critics of these policies have long moaned that this approach would ultimately create even more profound downside risks for U.S. banks. Among many other reasons, a flood of deposit liabilities at banking institutions could result in more aggressive credit risk management decisions that would result in even more widespread bank failures during an economic and/or financial market storm. And over the last two years, a spike in inflation coupled with the most aggressive monetary policy tightening cycle in more than four decades from the Fed has caused the rains to fall heavily in this regard, as a crippling decline in asset values have left many banking institutions with a gaping deficit relative to their deposit obligations. The steady flight in deposits from banks in pursuit of higher money market interest rates has only compounded the issue.

Prayin’ won’t do you no good. The U.S. Federal Reserve may say that the U.S. banking system is “sound and resilient”. But that doesn’t mean that the U.S. banking system is actually sound and resilient. For where I sit, I can find scores of financial institutions that are potentially teetering on the brink.

If we operate under the notion that price is at least some meaningful measure of truth from a market efficiency standpoint, we can compile a list of U.S. banking institutions that are seemingly most as risk of following the fate of the three banks that have already succumbed so far in 2023.

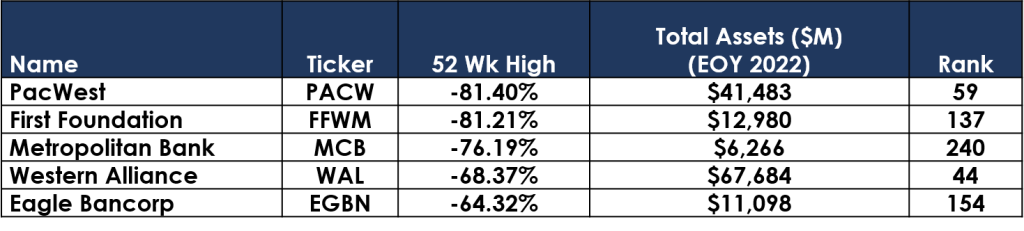

First, consider the list of bank stocks that are lower by nearly -65% or more from their 52-week highs. These are the institutions that appear most at question regarding their future viability.

While none of these institutions match the size the three major bank failures that have already come to pass in 2023, they still represent in aggregate nearly $140 billion in total assets, or another 0.6% of the entire U.S. banking system. And it remains likely that we are only making our way down the tip of a potentially major iceberg.

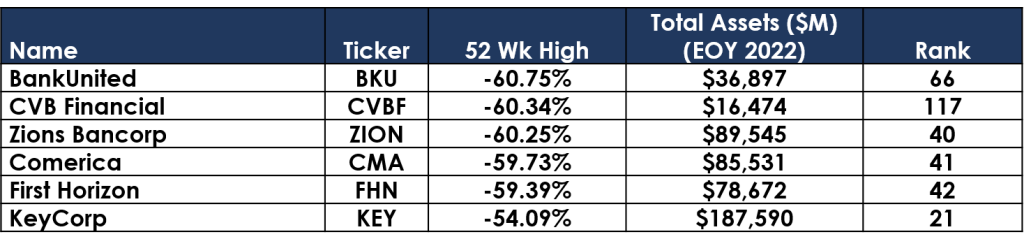

To this point, consider some of the banking names that reside in the next tier. These are banks that have fallen by roughly -55% to -60% or more from their recent peaks, which is measurably more than the -51% peak-to-trough decline in the larger than the KBW Nasdaq Bank Index, a breathtaking decline in its own right when considering that the financial institutions that lend to small and mid-size businesses across America effectively represent the heartbeat of our economy.

Together, this subset of banks that reside in this next tier represent another nearly $500 billion in total assets, or an additional 2.16% of all U.S. bank assets. And this doesn’t include the aggregate assets of all of the other smaller financial institutions that are adrift in these same waters. What is also notable about these larger names listed above is that they are lower by more than two times the -21% peak-to-trough decline of the Financial Select Sector SPDR, which is the ETF sandbox where the bigs in the banking sector can be found.

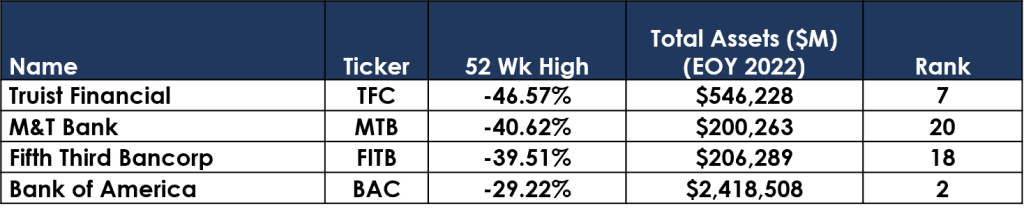

What of those titans of U.S. commercial banking? How are they faring as the financial levees are becoming increasingly breached with each passing month? If we see an accelerating wave of bank failures, how much more do the largest of the major U.S. banks have the capacity to absorb? The following are just a few of the selected names toward the larger side of the banking spectrum.

The fact that any of the names mentioned above have experienced meaningful declines well in excess of their underlying peer group benchmarks does not at all mean that insolvency is in their future. As we all know with systematic risk, a receding tide lowers all boats, and sentiment can cause some boats to fall more than others. But regardless of how the issues currently confronting the banking system play out from here, these institutions are clearly embroiled in an operational storm right now where protecting deposits and carefully managing risk will be paramount.

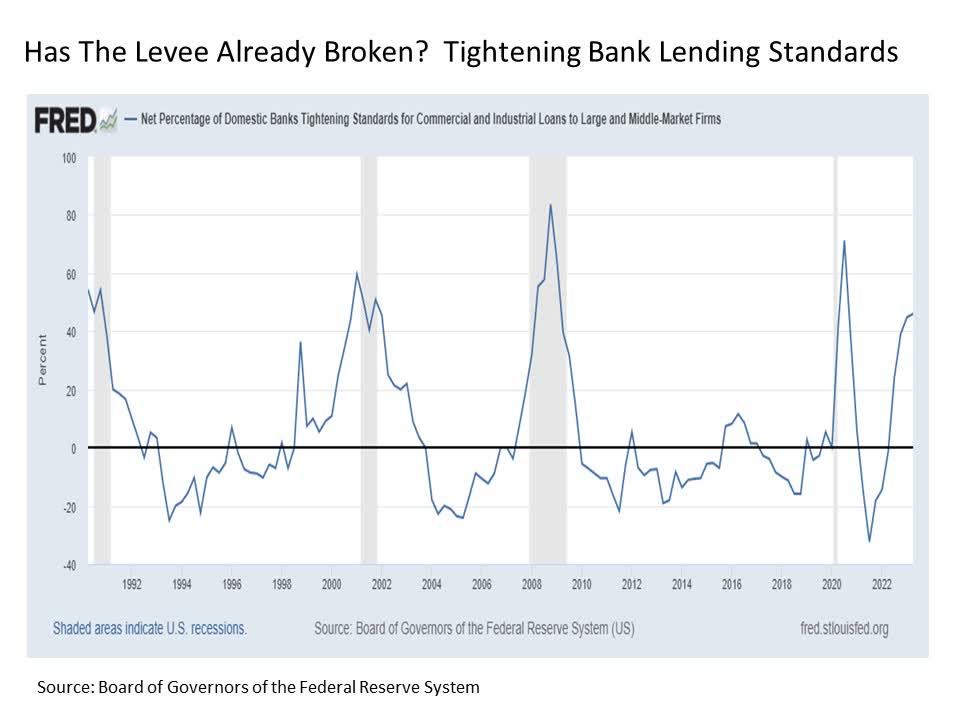

When the levee breaks, mama, you’ve got to move. Of course, if you are a financial institution operating in the current environment, the inclination is to protect capital and manage your business carefully regardless of your size. As a result, a material tightening in lending standards should be expected going forward as institutions maintain a focus on survival.

Earlier this week, the Federal Reserve Board released its latest Senior Loan Officer Opinion Survey (SLOOS) on Bank Lending Practices. This report contains a trove of data that details shifts in bank lending standards across a variety of metrics. A key summary indicator from this report is the Net Percentage of Domestic Banks Tightening Standards for Commercial and Industrial Loans to Large and Middle-Market Firms. In short, it shows the willingness, or lack thereof, of financial institutions to lend to the major corporations for the capital expenditures and fixed investment that help to drive growth in the U.S. economy. And a sustained tightening in this reading has historically been a reliable indicator of an existing or pending economic recession. The following chart shows this reading dating back over thirty years, with a rising line indicating tightening bank lending standards.

Today, bank lending standards are swiftly tightening, and they tightened even further in the most recent quarterly report. This suggests that an economic recession is likely starting in 2023 if we are not in recession already.

Now look here mama what am I to do? So what is the U.S. Federal Reserve to do in response to this burgeoning crisis in the U.S. banking system? Unfortunately, they have a complex policy bind with no clear answers. Such are the consequences of overly and arguably unnecessarily aggressive monetary policy for far too long in the more than decade long period leading up to today. As the old adage goes, be careful for what you wish for, in this case inflation, lest it come true. And true it certainly became these last few years.

The natural instinct is that the Fed should slash interest rates. This, of course, was the policy response de la decennie leading up to today. But here’s the problem. The Fed is still caught in an inflation battle in which it can ill afford to relent. Why? The reason that so many of these banks are battling for their lives right now is because the outbreak of sharp inflation caused long-term bond yields to spike higher (and thus the prices of these securities that so many banks held in size to plunge). The Fed had to raise interest rates as aggressively as they have had to it nearly a half century to thwart this inflationary outbreak, for if they kept interest rates low as inflation was spiraling, we could have quickly found ourselves with a 1970s style hyperinflationary redux, only potentially worse.

So can’t the Fed start cutting interest rates now or perhaps soon now that inflation is coming back down? Unfortunately no, for what the 1970s also taught us is that if the Fed either stops hiking interest rates or starts cutting interest rates too early in the wake of an inflationary outbreak, they run the risk of causing inflation to spark back up even worse than it was before. So even as inflation continues to fall back down and the economy potentially descends into recession if it’s not already there, expect that the Federal Reserve will remain stubborn in cutting interest rates, as they may need to keep interest rates high and actually push the economy further into recession in order to ensure that long-term bond yields continue to fall back lower to provide further relief to so many U.S. banking institutions that are struggling to keep their collective heads above water.

Goin’ down, goin’ down now. So what does all of this imply for financial market asset prices in the months ahead? U.S. stocks have been remarkably resilient in the face of so many pressures thus far in 2023. This has included leadership from high beta and low quality securities, which is not what might be reasonably expected in the current economic climate. But as we continue through the remainder of 2023, the risks to equity prices in general and these higher risk segments of the market in particular are measurably tilted to the downside from current levels. Favorable upside opportunities continue to exist in more defensive and discounted areas of the market, but now is likely a time to be more selective and to place a greater emphasis on higher quality and lower volatility. Beyond stock, the forward-looking environment is decidedly more favorable for prime rated fixed income such as U.S. Treasuries. As a result, a reasonable case could be made for increasing duration as the year progresses given the economic outlook and the Federal Reserve priority to deliberately lower longer term bond yields as inflationary pressures subside. Gold may also merit consideration given its characteristics as a hedge against economic uncertainty and potential instability.

As we sit on the banking system levee looking out over the summer ahead, it is a time to remain watchful and alert for any further risks that rise to the surface as the banking system rains continue to fall.

Note: credit to Led Zeppelin, Kansas Joe McCoy, and Memphis Minnie for inspiration behind this article.

Disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Approved for client use under tracking #436940-1.