The debate remains ongoing across the economic landscape and financial markets. Will the economy fall into recession between now and the end of the year? And will any looming economic slowdown push the U.S. stock market back into bear market territory? While a number of indicators are flashing conflicting signals, one historically reliable reading within capital markets is emoting a decidedly positive story. It is the junk bond market.

Default risk. High yield corporate bonds (a.k.a. junk bonds) represent loans issued to companies with credit ratings that are BB or lower. In contrast to investment grade bonds rated AAA to BBB that have a relatively low expectation of default risk, high yield bonds rated BB or lower are considered speculative grade in that they come with a higher probability that the issuer of the bond may not be able to make their interest payments or pay back the principal value of the loan. More simply, when it comes to high yield bonds, investors must worry more about getting their money back.

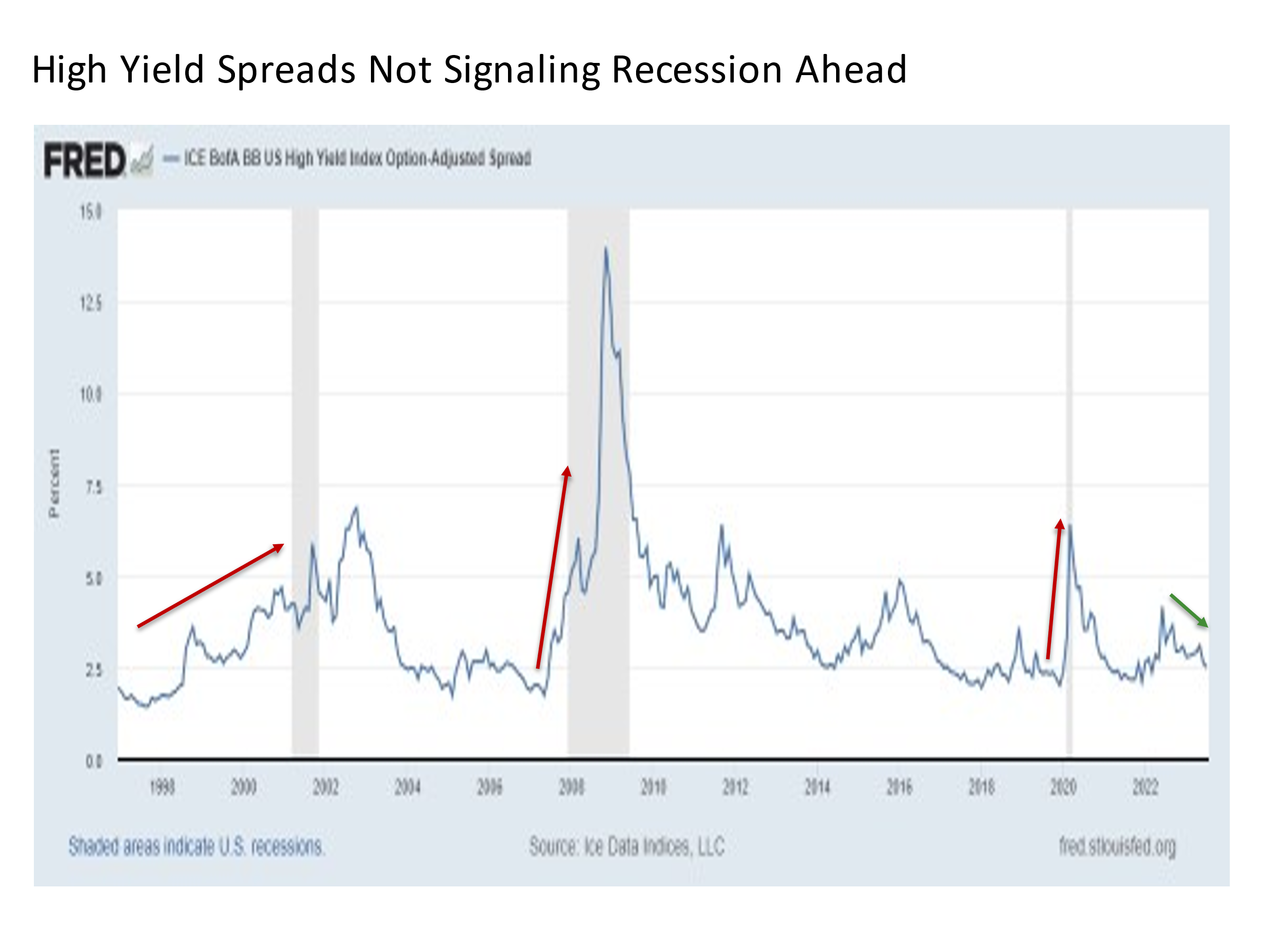

How junk can be useful. So how is the high yield bond market useful in predicting the likelihood of an economic recession and/or stock bear market? To answer this question, we consider the high yield option-adjusted spread, which at the risk of oversimplification is essentially the additional yield required by investors to take on the added risk of owning speculative grade bonds versus comparably dated U.S. Treasuries. This is shown in the chart below.

What we have seen over the past quarter century is that the additional spread required by investors to take on the added risk of owning high yield bonds has started to increase measurably in the months if not years before the onset of an economic recession and its associated stock bear market.

Where do we stand today? High yield spreads have been steadily declining from their 4.17% June 2022 cycle peak to 2.52% today. This represents a spread tightening of 165 bps, which is in stark contrast to the sharp widening seen prior to the bursting of the tech bubble, the onset of the Great Financial Crisis, or the outbreak of COVID. This is a positive signal against the notion of any looming economic recession or bear market.

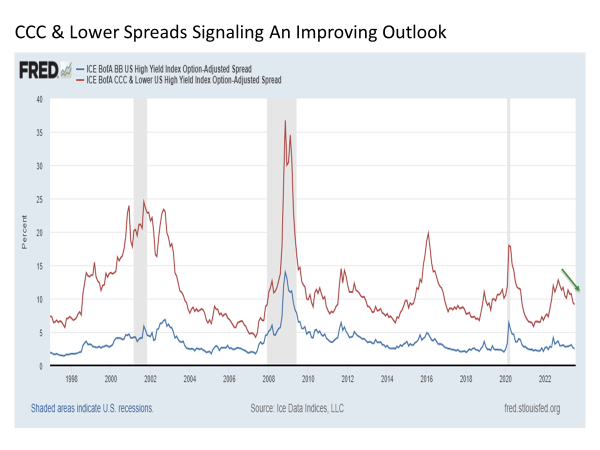

The junkier the junk, the more useful the signal. A valid criticism could be levied against high yield bond spread and their predictive ability. Yes, they blew out sharply as we descended into the last three economic recessions and bear markets. But while they provided a solid lead time ahead of the bursting of the tech bubble in early 2000 as spreads started widening out more than two years prior in 1998, relatively little advance warning was provided in 2007 and 2020.

To help address this issue, it is worthwhile to concentrate our focus toward the junkiest of the junk bonds. This is the CCC-rated and lower high yield bond space, which consists of bonds from issuers where default risk is not just highly possible in many cases but downright probable in the case of CCs in this group.

Why is focusing on these bonds in particular useful? Because in the earliest stages of investors starting to worry about the threat of an oncoming economic slowdown, they typically will begin parting ways with their most risky investments first. Thus, spreads have a tendency to start widening among CCC-rated and lower bonds even before we start to see it bubble up across the overall high yield space.

Looking back through recent history over the past quarter century, we see that the spreads on CCC-rated and lower bonds started widening in late 1997 and widened far more dramatically ahead of the tech bubble finally bursting. And while the widening of CCC and lower spreads was effectively coincident with the broader high yield bond space in 2007, we saw these lowest quality spreads widening measurably as early as mid 2018 well in advance of the recession that finally came with the onset of COVID.

What are CCC-rated and lower bonds signaling today? Not only are we not seeing any signs of stress in the form of widening spreads from this area of the bond market, instead we are seeing a marked narrowing of spreads that is even more pronounced versus what we are seeing across the broader high yield space. Since peaking at 12.81% in September 2022, CCC-rated and lower bond spreads have tightened by 368 bps to 9.13%.

Bottom line. The measurable tightening of high yield bond spreads in general and lower quality CCC-rated and lower bonds in particular is providing a decidedly positive signal for the economic and financial market outlook in the months ahead. Not only are these areas of the market not signaling any discernible mounting level of stress and risk aversion, they are instead signaling an increasing level of confidence among investors to take on additional risk through the rest of the year and into next.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.