The volatility across capital markets continues. Following a great summertime stretch, U.S. stocks have been tumbling to the downside since the start of August. As for the bond market, it was just three months ago in mid-July when the 10-Year U.S. Treasury yield rallied its way back to 3.75% before fast tracking its way up to 5.00% in the time since. While the fundamental case for why stocks and bonds may see better days ahead – strong economic growth, persistently tight labor market, declining inflation pressures, modest inflation expectations, improving corporate earnings, widening corporate profit margins, and historically attractive valuations (outside of the so called Magnificent Seven stocks) – the fact remains that capital markets remain under steady pressure during this historically challenging time of year from early August to mid-November from a seasonality perspective. As a result, it is worthwhile to take a look from a technical perspective by more closely examining the battle lines across capital markets.

Stocks. The U.S. stock market has been a model of resilience in recent months. Despite the sharp rise in yield across the Treasury curve (particularly the long end) that has sent the equity risk premium more meaningfully into negative territory, the U.S. stock market as measured by the S&P 500 Index has held up impressively. Yes, the headline benchmark index is off by -9% from its end of July highs, but it’s still trading above levels from last May before the summertime burst got started. And we are still +20% above the lows from October 2022.

So what are the technicals indicating that we should expect from U.S. large cap stocks going forward? Basically, two key battle fronts are set to converge in the coming weeks. The first is the upward sloping 200-day moving average (red line in chart above), which is a key support level for the S&P 500 from which stocks bounced earlier this month. The second is the downward sloping 50-day moving average (blue line in chart above), which has served as resistance for the S&P 500 dating back to August. The market is currently bouncing back and forth between these two converging technical levels. If current trends persist, the 200-day MA support and 50-day MA resistance are set to meet by the second week in November. This intersection will force an outcome – either the S&P 500 will burst to the upside above these two trendlines or break to the downside below these two trendlines.

What does this Chief Market Strategist anticipate will happen given this convergence plays out, all else equal (ceteris paribus)? Odds favor a burst to the upside given underlying economic and corporate earnings fundamentals not to mention the fact that the S&P 500 remains oversold from a technical perspective (see RSI reading just above 30). Of course, not all else is equal (mutatis muntandis?), so a lot can happen over the next three weeks between now and mid-November. And if a downside break were to occur, the next key support level is 4115 at the ultra long-term 400-day moving average (pink line in the chart above).

What about the rest of the stocks in the U.S. market? Looking a step down the size spectrum to U.S. mid-caps, we see a more challenged story (important note: what is about to be described here is virtually the same for U.S. large caps as measured by the S&P 500 Equal Weighted Index, highlighting how relatively strong the Magnificent Seven stocks of Apple, Microsoft, Amazon, NVIDIA, Tesla, Alphabet (Google), and Meta Platforms (Facebook) have been throughout 2023).

U.S. mid-cap stocks as measured by the S&P 400 Mid-Cap Index are lower by a more pronounced -15% since the end of July. In the process, they have returned to a key trendline support level for the Index at 2350. Mid-caps bounced on three previous occasions when arriving at this trendline support level, all of which took place amid oversold conditions (RSI around 30 or less) similar to today. While this Chief Market Strategist is expecting at least a short-term bounce from this level, if mid-caps were to break to the downside, the next key support level for the Index is at 2185, which is -7% below current levels.

U.S. small caps have a more challenging picture still. The S&P 600 Small Cap Index never really stopped trending lower following its late 2021 peak, and the most recent -16% lurch to the downside has the index closing in on retesting its October 2022 lows.

Providing reassurance for a potential bounce from this key support level beyond the fact that U.S. small caps are already oversold (once again, RSI around 30) is the fact that the October 2022 lows were also effectively the February 2020 highs right before the outbreak of COVID. As the old technical analysis saying goes, what was once resistance has now become support. It will be interesting to see if this holds true for small caps today.

Bonds. The pain in bonds over the last few months has been real. But before going any further, it is important to put the recent backup in yields in context. The monstrous move higher in bond yields took place over a year ago now when the 10-Year U.S. Treasury yield exploded higher from a low of 1.35% in December 2021 when inflationary pressures were already simmering to a high of 4.25% less than a year later in October 2022. Breaking this down, we saw a near 3 percentage point jump in 10-Year U.S. Treasury yields in just 10 months. This is an epic level of pain for bond investors.

So what have we seen more recently? Bonds did rally fairly strongly for nearly seven months coming off of the October 2022 lows, with the 10-Year Treasury yield falling back as low as 3.37% by early May 2023. But once it started to dawn on investors that the long anticipated economic recession was not coming (not to mention China and Japan increasingly coughing up Treasuries), yields started pushing back higher through today.

The echo move higher in bond yields this year has been fairly swift in its own right. And where we stand today, Treasuries are both oversold and overdue for a fairly meaningful rally given how far beyond the moving average trendlines we stand today in an environment no less where inflation pressures continue to sustainably decline.

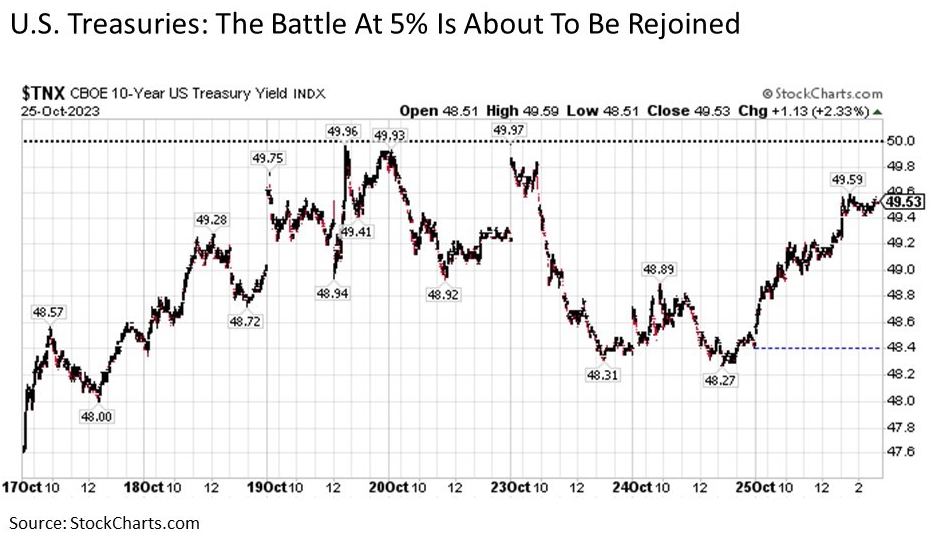

Nonetheless, the major battle line for the 10-Year U.S. Treasury is the 5% yield level. Let’s take a closer look on an intraday basis below.

The 10-Year Treasury market took its first sustained run at breaking above a 5% yield late in the day last Thursday, only to get quickly turned back. Another run was taken early the next morning last Friday, only to be once again swiftly swatted back through the remainder of the trading day. Like a battering ram, the Treasury market made a third run at breaking above 5% at the open of trading this Monday, but once again buyers at this key yield level firmly held the line, pushing the 10-Year lower by nearly 20 basis points through the close of trading on Tuesday. But by the time markets reopened for Wednesday, bond investors were gearing up for another charge at 5%, having pushed the yield steadily higher to 4.95% by the end of the trading day. It is very possible that by the time this article is broadly published, that this 5% support level in the 10-Year Treasury yield has been taken out. If so, the next support line in the sand is 5.25%. But if bond investors can hold the line at 5% between now and the end of the week, the longer they hold this support level, the more likely it is that sellers will capitulate and buyers will take the upper hand.

Now for some stock only investors, they may read the above content about bonds and say “why should I care about what the 10-Year Treasury market is doing?”. Beyond the fact that the bond market plays an important role in determining stock valuations and the equity risk premium, stock investors should be particularly interested in how bonds in general and Treasuries in particular perform from here. Treasuries are overdue to rally. Way overdue, as a matter of fact. And when and if they finally do, this is likely to put some rocket fuel behind stocks to the upside as well. Why? As Treasury yields come back down, they become a less attractive alternative to own versus stocks for the same stock valuation and equity risk premium elements mentioned above. In short, if Treasuries start to rally and the 10-Year yield starts to drop, look for stocks to fully join in on the upside action.

A quick word from gold. What about the investor that is suffering the current market environment that might be saying to themselves “I don’t want to endure the risk right now, so maybe I’ll sit things out until the stock and bond market settle down”. Given the strong fundamental backdrop described above along with technically oversold levels, such attempts to time the market are likely ill advised at the present time. And gold gives a good example of the perils of trying to wait things out until volatility subsided.

Starting in mid-September, gold suddenly started to get kneecapped. Over the course of twelve trading days from September 20 to October 6, gold shed more than -7% of its value amid a wave of relentless selling. But no sooner did the first week of October come to an end and the gold market took off like a bottle rocket to the upside. Over the course of eleven trading days, not only did the yellow metal move more than +2% above its September 20 starting point, but it briefly broke back above $2,000 per ounce in the process.

Try to time such market moves at your own peril. For just as suddenly as gold was melting to the downside was as quickly as it was surging right back to the upside. And if I pulled a mini Rip Van Winkle and checked out in mid-September for a few weeks, I’d come back looking at a tidy incremental gain none the wiser about the price ravine that came and went along the way. This is just one of countless examples of the importance of sticking with your discipline and remaining fully invested.

Bottom line. The battle lines are currently drawn across capital markets including stocks and bonds. And how these engagements are resolved in the coming days and weeks will go a long way in determining whether deeply oversold levels in both stocks and bonds will start to be resolved, or if further short-term downside lies ahead.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: #496848-1