Christmas came early to capital markets on Wednesday. The U.S. Federal Reserve emerged from its latest Open Market Committee meeting on Wednesday with good tidings for investors, sharing tales that inflation continues to come down and labor markets coming into balance. But the biggest gift under the tree was the Fed’s median projection for three quarter point rate cuts in the New Year. Much like Christmas, maybe not all that was dancing in the head of investors, but still an abundance of monetary gifts under the market tree. What does this all mean for markets heading into 2024?

Come on, we’re going for a sleigh ride. Capital markets are rightfully ebullient in the wake of the Fed news. The S&P 500 Index had already jumped by more than +13% since the end of October heading into the Fed meeting, and it added another +1.4% on Wednesday by the close of trading after the Fed’s press conference. Bottom line – new all-time highs on the headline benchmark are now within striking distance by the end of 2023 at only +2.4% more above current levels as we close out the second week of December.

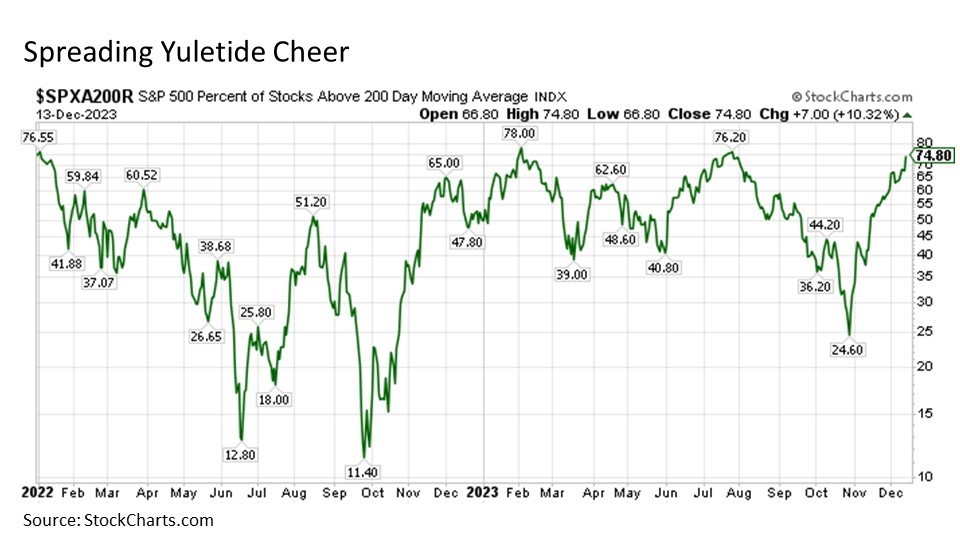

Spreading investor cheer for all to hear. It’s not just the Magnificent Seven and the very top of the stock market Christmas tree that is shining in the wake of the Fed’s cheer. Market breadth burst higher, with nearly 75% of all companies in the S&P 500 now trading above their respective 200-day moving averages. In short, the stock market party is on and more and more stocks are coming to town.

We see this in particular among U.S. small cap stocks. Unlike U.S. large caps that managed to shake off 2022 and rally throughout much of 2023, U.S. small caps never really shed the bear market blue Christmas from a year ago. But following the Fed’s latest spiking of the monetary policy punch bowl, U.S. small caps have broken decisively to the upside.

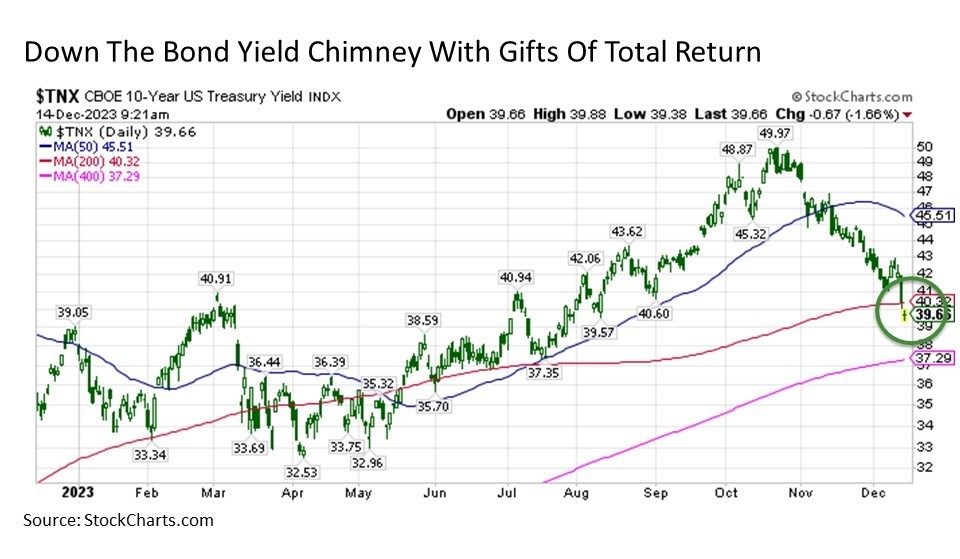

Green sleeves. The capital market merriment is not limited to the stock market in the wake of the Fed meeting, as the bond market is also flying to the upside. For example, U.S. long-term Treasury bonds had already bounced by +15% from the October lows heading into the Fed meeting, and subsequently tacked on another +3% in the wake of the Fed announcement. This sent the 10-year U.S. Treasury yield slicing through its 200-day moving average resistance and down below 4% for the first time since Christmas in July.

Treasury yields from effectively 5% in mid-October to below 4% less than two months later in mid-December is a total return rally of epic proportions not only for the prime quality bond market in general but risk asset markets in general.

White Christmas. In the midst of all of this capital market yuletide cheer, it is important for investors to not lose sight of the things that remain paramount in managing and investment portfolio over time. This includes keeping a sharp eye on the potential downside risks that may emerge down the road from policy actions today.

To begin, both stocks and bonds have had a phenomenal upside run over the last month and a half. As a result, both U.S. stocks and bonds are meaningfully overbought from a relative strength (RSI) perspective. So while the good news is that a favorable upside runway still exists for both stocks and bonds to advance in the New Year, investors should be prepared over the coming weeks for at least a period of sideways consolidation if not a short-term pullback following recently frothy gains.

Next and much more importantly, what I had viewed as the primary downside risk for capital markets in the second half of 2023 has now reemerged as a primary downside risk heading into 2024. This is the threat of a renewed rise in inflation. Pricing pressures have been steadily falling since their peak in mid-2022, and they continued to drop in recent months despite concerns that they could reignite due to pressures such as higher oil prices. If the prospects for easier monetary policy ends up sparking a renewed rise in inflation, it would require a 1970s/1980s era style policy response to get it back under control, and markets would like that about as much as a kid likes getting coal in his stocking for Christmas.

Bottom line. Markets have taken flight in the wake of the latest Fed policy announcement. And these gifts being brought by the Fed, even if they are only conceptually what may come in the next year, are likely to go a long way in propelling capital markets to a good start in 2024.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 517339-1