So much feels great about capital markets as summertime temperatures heat up. But the U.S. economy is offering up a soft and cool economic twist with the start of the beach season. As fireworks like NVIDIA continue its march past $3 trillion toward becoming the largest company in the world by market cap and GameStop is suddenly back to posting daily stock price doubles, it’s important to also keep an eye on the daily economic waves rolling in throughout the summer.

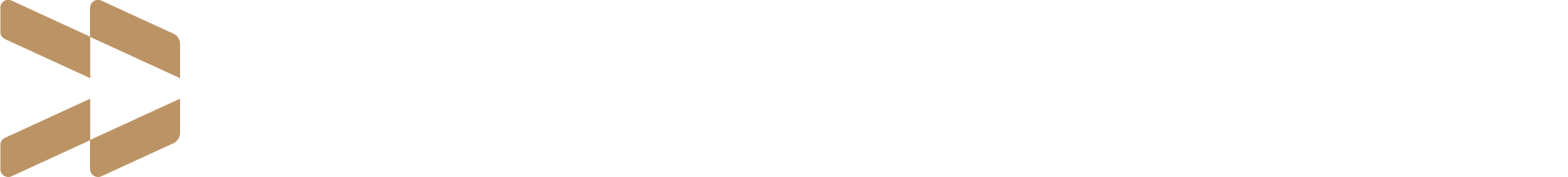

Vanilla. While much of the economic focus so far this year has been around a U.S. economy that has persistently been stronger than expected, the first cup of economic soft serve is coming from output growth indicators. Consider the Atlanta Fed GDPNow real GDP estimate for the current quarter, which is shown in the chart below.

Reminiscent of a visit to Niagara falls, the latest forecasts for economic growth have suddenly cascaded to the downside over the last two weeks. Driving the waterfall in growth projections has been a measurable reduction in expectations for consumer spending reflected in weaker than expected jobs data coupled with weaker than expected readings in manufacturing and construction spending. As a result, we now see GDPNow forecasts for economic growth that are lower than the Blue Chip consensus of leading economists. This is a stark contrast to what we have seen for most of the last two years where consensus economists were more pessimistic than the GDPNow projections (it’s worth noting that the same is effectively true for the recently reinstated New York Fed Nowcast).

Put simply, projections for U.S. economic growth are suddenly slowing. And various leading indicators suggest that this cooling may continue through the remainder of the year.

The investor pessimists might see this economic soft serve as a reason to retreat from equity investments, particularly given their already steaming valuations.

The investor optimists, however, might actually rejoice at these signs of a slowing economy. We’ve already been feasting on a picnic of consistently strong corporate earnings and abundant financial market liquidity, and now a slowing economy may inspire the U.S. Federal Reserve to finally loosen up and lower interest rates as so many anticipated coming into 2024. Win win, amirite?

Chocolate. Economic soft serve is often served in a twist. While a slowing economy may start to clear the path for the Fed to lower interest rates, if only it were that easy. The Fed has an explicit dual mandate – maximum employment (GDP, jobs, etc.) and price stability (inflation). If we’re drifting away from maximum employment as suggested above, the Fed has a potential reason to cut rates. But it must consider this move in the context of the inflation situation. And regardless of what the headline inflation data might be telling you, one need not search long or far for a U.S. consumer that continues to agitate about things being a lot more expensive today than ever.

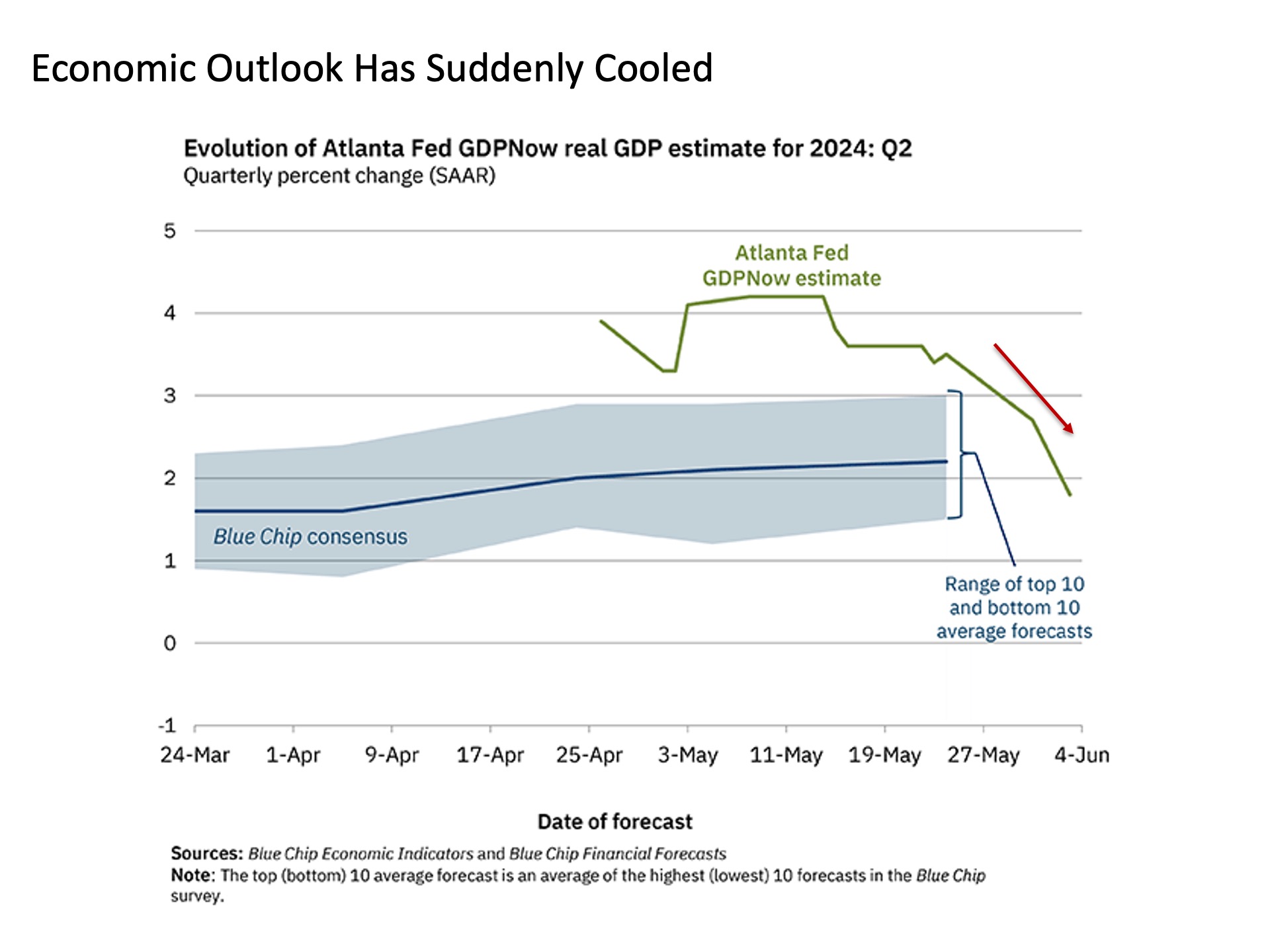

A first look at the inflation data suggests that it’s still all good on the inflation front. Yeah, prices are still rising on a headline (blue line below) and core excluding the more volatile food and energy components (red line below), but they are rising at an increasingly lower rate, down from the 6% to 9% readings from 2022 to below 4% and still falling today. Still work to do, but heading in the right direction. All good for the Fed to cut, amirite?

Oh, if only it was that simple. What about that green line in the chart above? The headline data may look OK, but just like the performance of the S&P 500 when you take out NVIDIA (not nearly as good as the headlines might suggest), the same holds true when looking at economic data like inflation. For when we dive under the surface, we see some troubling developments on the pricing front that warrant close attention in the months ahead.

The green line in the chart above is the inflation rate for services in the U.S. economy outside of the cost to own or rent a place to live. Think services like your water and trash collection bills, your doctor bills, your car insurance, your vet bills, and the cost for movie and sporting event tickets among many others. In short, it’s all the things we spend our money on each month in the course of living (and hopefully enjoying) our day to day lives. This services ex shelter inflation rate had been falling since 2022 even faster than the headline readings reaching a low of just 2.8% by last September. But since the end of 2023 and through 2024 so far, this services ex shelter inflation rate fire has roared back to life. As of the latest reading for April 2024, it’s closing in on 5%. Hot, hot, hot!!!

Jimmies. Let’s put this together so far. We suddenly have signs that the economy is slowing in a meaningful way. At the same time and much like ice cream dripping out of the bottom of a cone, we have inflation readings lurking under the surface that are running hotter than expected. This is not the soft serve combo that will induce the Fed to lower interest rates. Why?

First, the Fed is already still blistering from the 2021-22 sunburn when they first injected waaay too much liquidity in response to the COVID crisis and then waited waaaaaaaay too long to withdraw this liquidity, thus laying the kindling for the inflation fires that burned brightly in 2022 and continue to smolder today. The Fed has already undermined the credibility of their inflation fighting chops, so they need to be slow, deliberate, and persistently laser focused on keeping the inflation fires out before turning their attention to supporting economic growth. In other words, if anything, the Fed is likely err on the side of waiting to raise rates in the months ahead, even if the economy continues to slow.

Second, while it may be a distant memory if anything for most of us, but the Fed as an institution remembers all too well the lessons of the stagflationary 1970s when they faced similar challenges of slowing economic growth and rising inflation. Back then, they chose lowering interest rates to support economic growth over fighting inflation three consecutive times, and each time they ended up with an even worse inflation problem that crushed the economy anyway. The lesson learned is that the Fed must fully extinguish inflation pressures first before they can turn toward supporting the economy (see the 1980 and 1981-82 recessions).

Thus, for those hoping for a Fed rate cut on these initial signs of a fading economy, don’t hold your breath.

Bottom line. If, and big emphasis is on the word IF, the economy continues to show signs of slowing (it may quickly pick back up) as we move through the summer, keep a close eye on the inflation data. For IF underlying inflation readings continue to run hot, we may end up in a situation where the economy is slowing while the Fed remains focused on the inflation fight, thus not cutting interest rates (and maybe even starting to talk about raising interest rates – GASP!). Chances are, capital markets may not like this economic soft serve twist if it ends up getting served.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 588697-1