It has been a primary downside risk for financial markets for more than a year now. But after repeatedly coming in hotter than expected in many reports so far in 2024, the latest reading on inflation surprised the markets by coming in cooler than expected on Wednesday. Capital markets rejoiced on the news with stocks, bonds, and gold all ripping to the upside. Are investors suddenly on a more peaceful journey for inflation going forward?

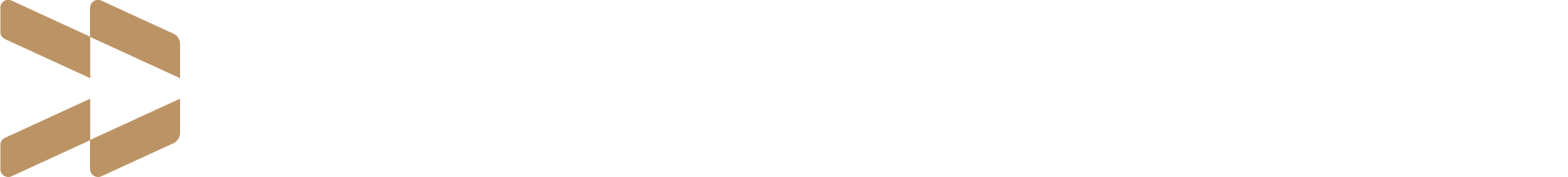

Report. The U.S. Bureau of Labor Statistics released their latest monthly readings on inflation for April, and the headlines looked resoundingly cool. The annual rate of headline inflation came in at 3.36%, and the annual rate of core inflation excluding the more volatile food and energy components was 3.62% last month. Not only did both readings come in lower than expected, but they also represented declines in the annual inflation rate from 3.48% on the headline and 3.80% on the core from the previous month in March. While both readings remain well above the pre-2022 inflation rates, they continue to trend in the right direction for investors, which is lower.

Investors were understandably excited by the news. After so many stronger than expected readings on inflation throughout 2024, the fact that the latest reading for April came in cooler than expected gave inspiration that we may have finally reached the long anticipated juncture where inflation may start slowing more definitively to the point where the U.S. Federal Reserve can start to more actively consider cutting interest rates. And the post Great Financial Crisis period taught us all too well how much both stocks and bonds love a Fed interest rate cutting environment.

Context. Not so fast. Yes, the latest CPI brought good headline news, it is important to emphasize that this is only the latest CPI report. More simply, one data point does not a trend make. We need a few more monthly reports for May and June and July and so on before we can justify getting too excited about inflationary pressures starting to cool off more dramatically.

It’s also important to note that while a cool CPI reading may be welcome news, the U.S. Federal Reserve’s primary reading on inflation is not the Consumer Price Index. Instead, it is the Personal Consumption Expenditures Price Index, which comes out for April in a couple of weeks at the end of May.

Nonetheless, a good headline is a good headline. But what about the true substance of the report? For that, let’s look under the hood.

Closer look. The annual rate of inflation has been trending lower dating all the way back to mid-2022, which continues to be good news. Even as recent inflation readings have come in hotter than expected, the longer-term trend remained flat to lower, which is even more constructive. And looking ahead to the rest of 2024, it is currently expected that this trend of lower annualized inflation will continue through most if not all of the remainder of the year.

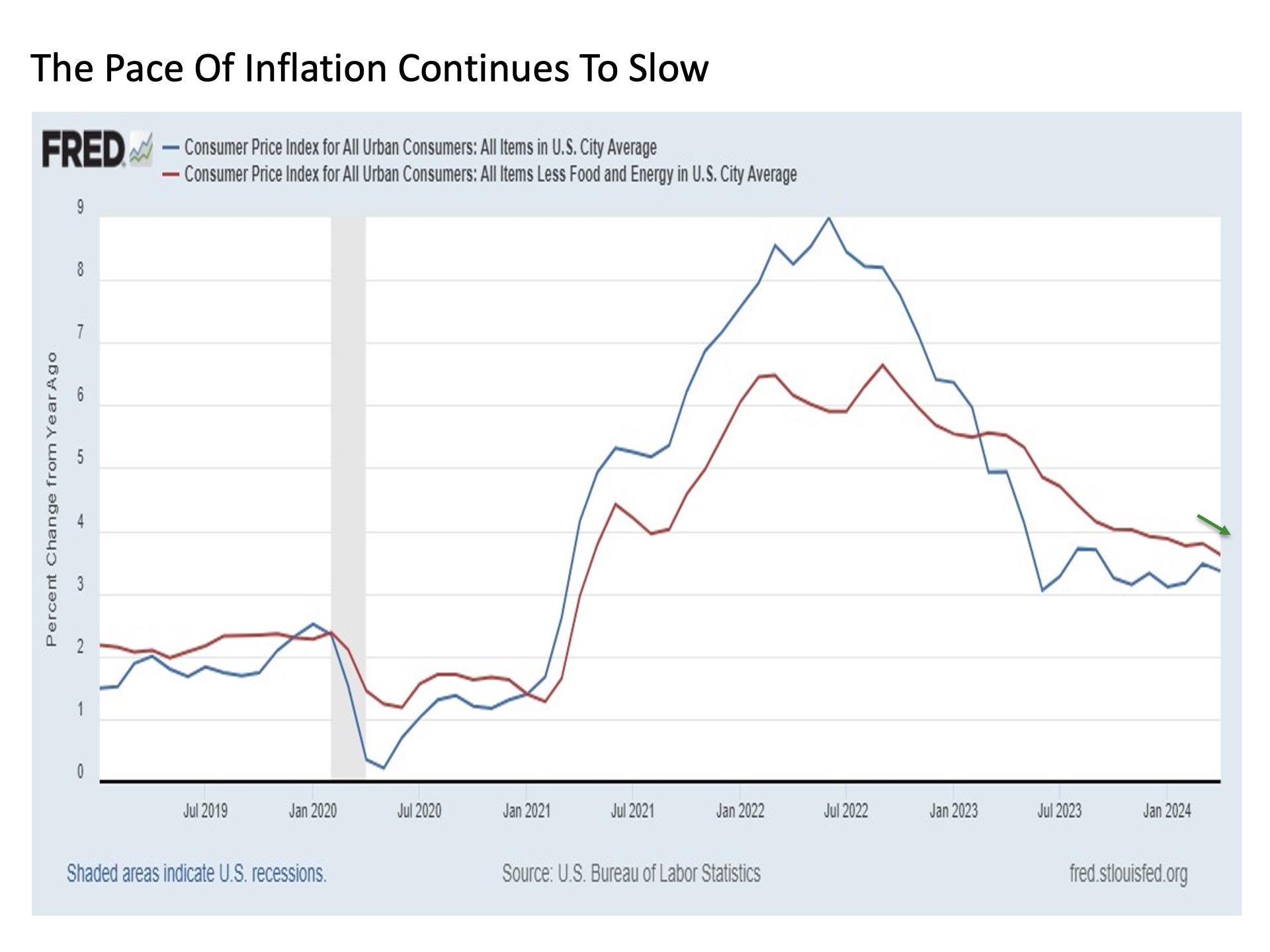

This does not mean that the inflation outlook is not without risks or ongoing challenges. A major point of current concern on the inflation front resides right below the surface. While headline and core inflation is fading on an annual basis, these declines are being driven almost exclusively by a year-over-year decline in core goods prices. On the other side of the coin is core services prices, and it is here where we are seeing some disconcerting trends that need to be watched closely in the months ahead.

The rate of core services inflation has flattened out in recent months. In fact, it has barely budged lower for the last seven months and counting dating back to October 2023. Of course, the same could also be said for the headline CPI inflation rate, which has been stubbornly stuck for nearly a year since last June. But the bigger problem with the stalling in the decline of core services inflation is that it has flattened out at a relatively high level north of 5.3%. This is still hot inflation on an absolute basis.

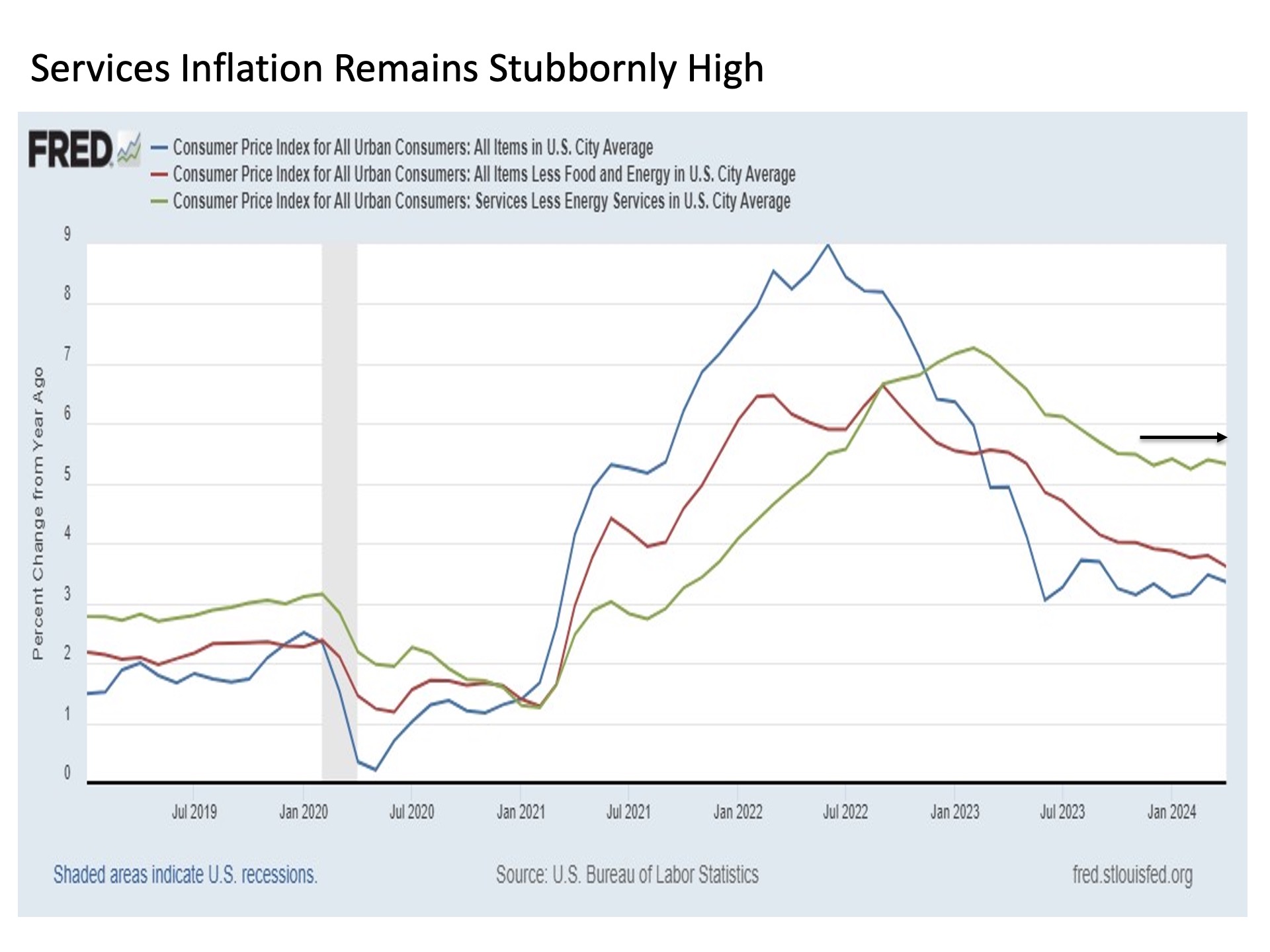

Let’s look a little deeper into this potential pocket of inflation trouble underneath the headline surface. Core services inflation has indeed flattened, but it is made up of a variety of component parts. Leading among these is shelter costs, which have been steadily fading in their own right despite the broader core services reading turning flat. But when you strip out shelter prices from core services, we see a troubling trend picking up steam.

The annual rate of core services inflation excluding shelter peaked back in September 2022 and had been steadily and sharply slowing since. That is until September 2023 when it reached as low as 2.76%. Good stuff. But since late last year, this core services reading excluding shelter has reaccelerated sharply to the upside. This includes hitting a new recent peak at 4.89% with the April reading that is up 12 basis points over the 4.77% reading the prior month in March.

This is a potential problem that warrants continued close attention in the months ahead. For if consumers continue to see blistering price increases for necessary services like hospital stays and the like into the second half of the year, it not only has the potential to spill over into broader inflationary pressures, but it is taking money out of the pockets of consumers that they might otherwise spend elsewhere to support further growth in the U.S. economy in the quarters ahead.

Fed watch. With all of this being said, market and investor expectations are still definitively on the side of lower inflation in the months ahead. This is best highlighted by Fed interest rate cut expectations. For while the market remains arguably too optimistic in thinking that we may see one quarter point rate cut from the Fed in July/September and a second quarter point rate cut by the end of the year in December (this Chief Market Strategist sees a maximum of one quarter point rate cut and not until December if at all), the more important point is that the market is currently assigning a zero percent probability of a Fed rate increase through September 2025. In short, market expectations remain fully biased toward the further slowing of inflation, which is constructive for markets and asset prices as we continue into the summer months.

Bottom line. The latest reading on inflation was indeed good news. But risks are lurking underneath the inflation headline surface that warrant continued monitoring. Nonetheless, the overall outlook for inflation remains constructive through the remainder of the year, which continues to be supportive of asset prices including stocks and bonds.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.