It’s been a haunted ride for capital markets over the last two years. And just when it looked like the horrors were finally coming to an end this past summer, the last few months have seen the stock and bond market demons rise again. While a new dawn may still lie ahead for capital markets in the coming months, here are a few scary risks confronting investors today.

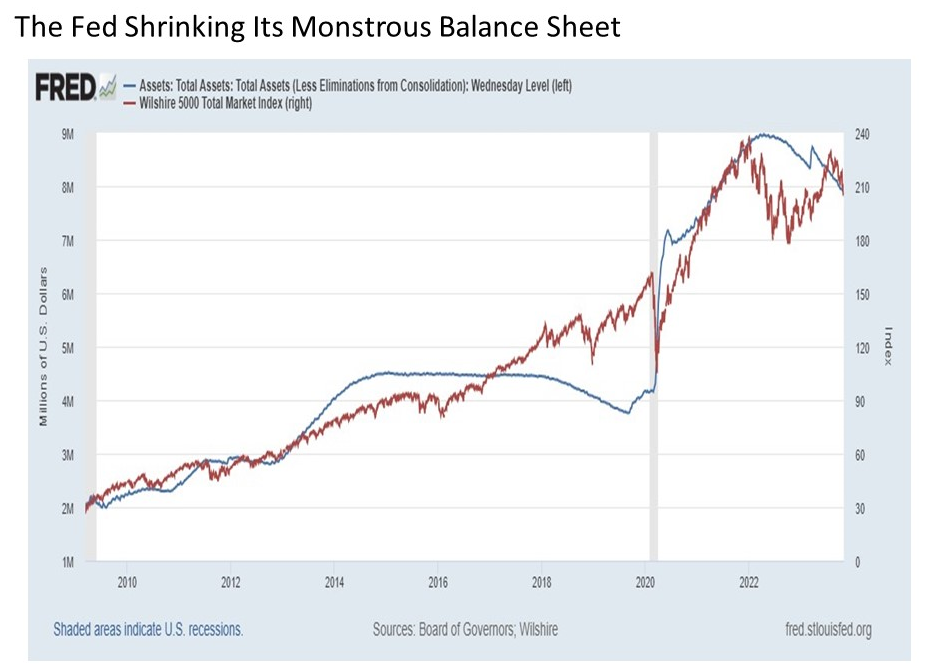

Shrinking monster. Monetary policy actions from the U.S. Federal Reserve have been a primary determinant of market returns dating back to the Ben Bernanke “Green Shoots” interview coming out of the Great Financial Crisis in March 2009. Over the 13 year period from early 2009 to early 2022, the Fed exploded its balance sheet by nearly five times through a series of “quantitative easing” large scale asset purchase programs. The goal of these programs was to stimulate sustainably strong economic growth through a “wealth effect” while also warding off the deflation demons by bringing inflation up to the somewhat arbitrary target rate of 2%. While the programs continuously failed in generating much more than sluggishly artificial economic growth and chronically below target inflation, they did wonders in stoking asset prices like stocks in a big way.

So what’s scary about the Fed balance sheet monster today? Once the Fed finally went a few trillion too far with their balance sheet expansion in response to the COVID crisis (a health crisis, mind you, not a financial crisis), they’ve been fire fighting to bring inflation back down since early 2022. While much of the attention thus far has focused on how the Fed slammed their foot through the car brake floor with more than five percentage points in rate hikes in just over a year (breath taking, break a bunch of bad credit risk taking regional banks kind of wow), what I worry about far more now that the inflationary beast continues to be tamed is the ongoing and marginally accelerating shrinking of the Fed’s balance sheet going forward.

Put simply, if trillions of Fed balance sheet expansion for more than a decade helped propel stock prices to the moon, it’s not beyond reason to think that Fed balance sheet contraction may bring these same stock prices back down to earth.

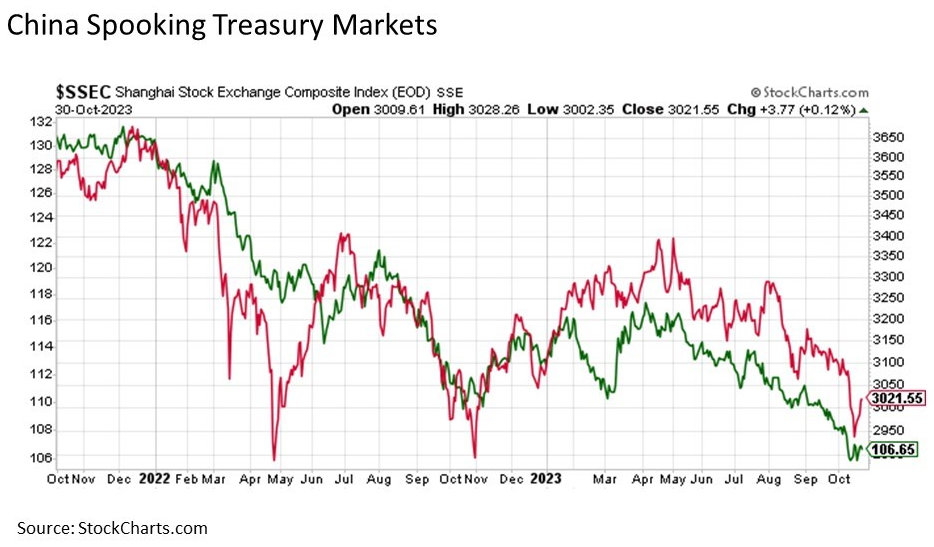

Red market scare. The China economy and its markets have been struggling for some time now. The commercial real estate boogeyman that remains elusive here in the United States has been alive and well and on a rampage in China. And asset management firms have been buckling under the challenging operating environment and increased regulatory intervention by Chinese authorities. Given that U.S. assets are intertwined with financial activity in China in many ways, we have seen this downside pressure feed through to weakness in the U.S. Treasury market in a meaningful way over the past two years.

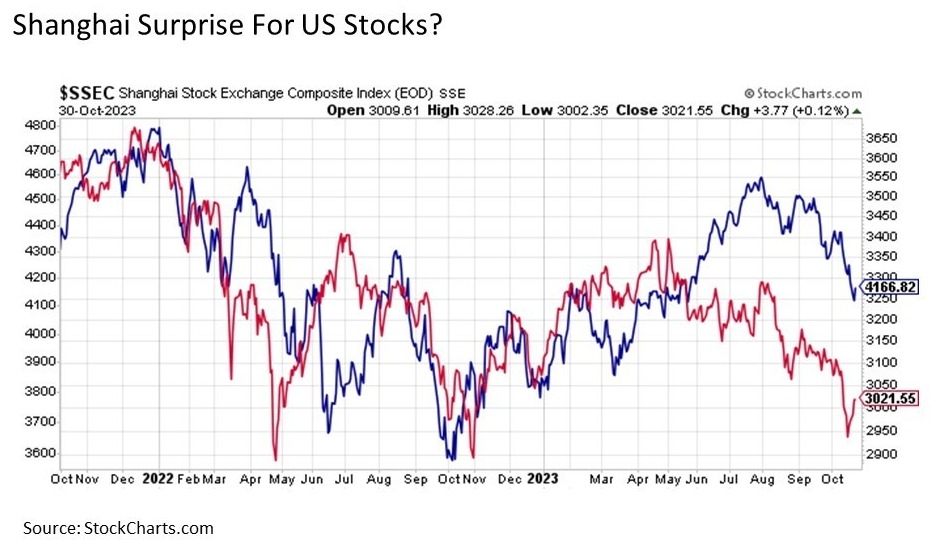

What is notable is that U.S. stocks as measured by the headline benchmark S&P 500 were also following a similar path from late 2021 up until June of this year until suddenly U.S. stocks broke off to the upside as China stocks rolled back over to the downside. Given the gap that now exists between the recent performance of the S&P 500 and the Shanghai Stock Exchange Composite Index coupled with the pace of the recent U.S. stock market decline, it is reasonable to worry that the S&P 500 may ultimately fall down to the price currently implied by the Shanghai index at around 3750.

The good news is that when one takes out the Magnificent Seven stocks of Apple, Microsoft, Amazon, NVIDIA, Tesla, Alphabet, and Meta Platforms from the returns over this recent time period, we see that the equal weighted S&P 500 not to mention the S&P 400 Mid-Cap and S&P 600 Small Cap are all already trading effectively at their corresponding respective price implied by the China stock market. In short, the feared downside is already baked in for nearly all of the U.S. stock market outside of a select few really big names.

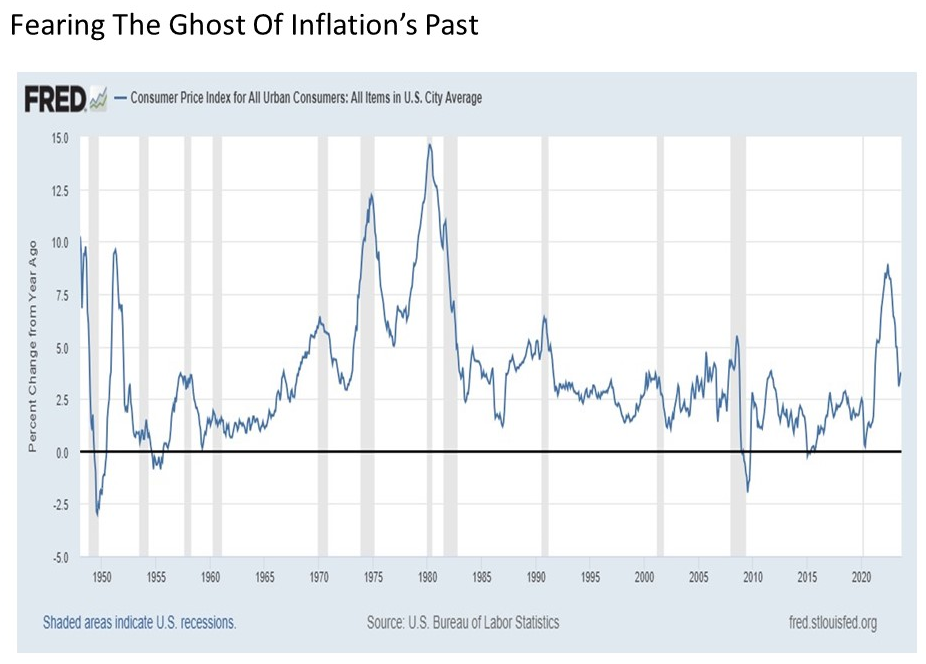

Ghosts of inflations past. So what is arguably most worrisome as we move through the remainder of 2023 is the ongoing threat of a renewed rise in inflation from the grave. Let’s get straight to it – everything lines up well things getting back to a bullish normal going forward with persistently strong economic growth coupled with diminishing inflation concerns. Good stuff, and this has been what has been playing out to date as inflation pressures continue to subside.

But what if it turns out that the inflation pressures reignite in a meaningful way? This would be decidedly bad news for both stocks and bonds, as it would mean that corporate earnings would almost certainly take a hit and corporate profit margins would likely start to shrink. Perhaps more importantly, the Fed would likely restart raising interest rates even further so that they don’t repeat the same 1970s style inflationary and/or stagflationary outcome.

Fortunately, inflation continues to trend in the right direction and even periodically exceeds expectations by coming in softer than anticipated in recent months. As long as these gradual, still above trend pricing declines continue, then waning inflation will likely be an increasing marginal tailwind.

Bottom line. While my outlook for stocks and bonds remains constructive in the months ahead, we are also not without meaningful potential market scares that may arise like those described above. These among others remain worth watching closely for developments as we navigate the weeks and months ahead.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 500065-1