Summary

- The bond market is regaining its footing as inflationary pressures continue to wane, with investors showing confidence in improving conditions for the asset class.

- Favoring U.S. Treasuries over investment-grade corporate bonds and mortgage-backed securities is recommended for the second half of 2023 due to the current market environment.

- The yield premium for owning corporates remains thin relative to history, and Treasuries typically perform better than investment-grade corporates during periods of economic weakness.

Bonds are back. Much like the stock market that bottomed last October, the bond market also struck a peak in interest rates around the same time. But while stocks have been striding to the upside in the months since, the rebound in bonds has been more gradual and uneven thus far. Fortunately, a tailwind is accumulating behind the bond market, particularly with inflationary pressures continuing to wane. Thus, it is reasonable to consider which segments of the bond market are best positioned to benefit as we move into the second half of the year.

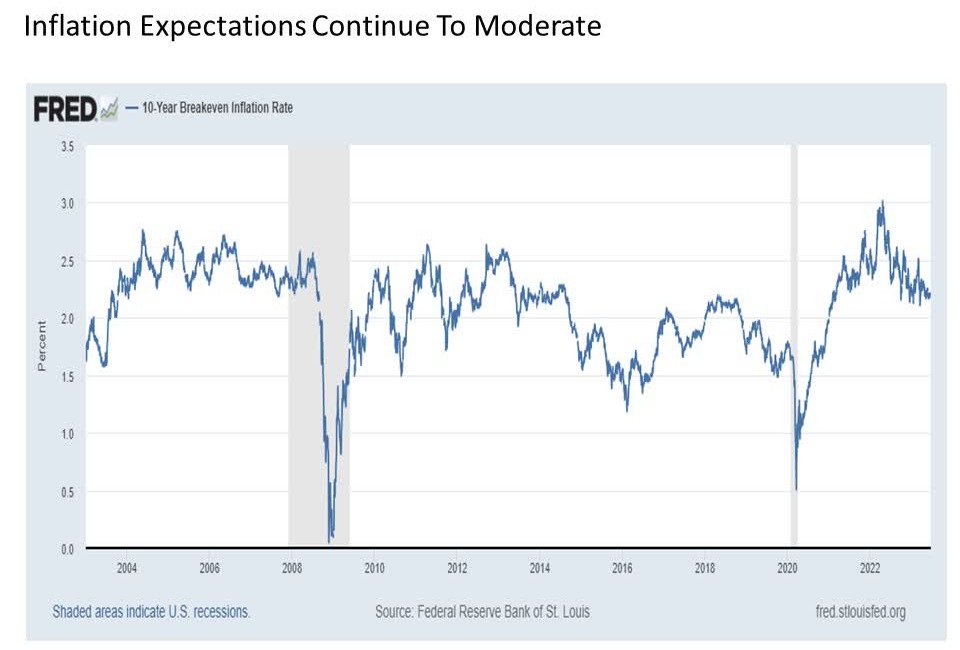

Bond believers. Overall, bond investors are showing confidence that conditions will continue to improve for the asset class. One way this is most clearly represented is through inflation expectations. Recognizing that inflation expectations is one of the primary determinants of bond returns along with time to maturity, liquidity, and default risk, it is worthwhile to consider how the market sees inflation playing out over the coming years. And when looking at the 10-year breakeven inflation rate, which represents investor expectations for inflation over the coming decade, the view is increasingly constructive.

After peaking at a still fairly reasonable 3% in March 2022, inflation expectations have steadily declined in the fifteen months since. And at just over 2% today and still trending lower we are already back to inflation expectations levels that defined the disinflationary post Great Financial Crisis (GFC) period prior to the onset of the COVID crisis. So while the decline in inflation has recently been more gradual than expected, the market maintains confidence that the Fed will get the job done in bringing pricing pressures back lower.

The notion that inflationary pressures will continue to fade is supported further from a fundamental economic perspective, as the probability for a recession over the coming year remains high, bank lending standards are likely to tighten further as banks continue to deal with the threat of deposit flight and depressed asset values, and global sovereign and institutional indebtedness levels remain chronically high.

Assessing the landscape. Given the upside opportunity developing in bonds, it is reasonable to consider where the most favorable opportunities are concentrated in the current market environment. Put simply, favor U.S. Treasuries over investment grade corporate bonds and mortgage-backed securities (MBS) as we move into the second half of 2023.

The reasons for tilting toward Treasuries over MBS today are fairly straightforward. While selected relative value opportunities may certainly exist in the MBS space today, the reality remains that what was once a relatively short duration category as homeowners regularly refinanced their mortgages at historically low interest rates has become over the last many months a relatively long duration category as mortgage rates have shifted markedly higher and homeowner refinancing has slowed dramatically. Put simply, for the many homeowners that refinanced over the last decade to get their mortgage rate as low as possible, they are now content to lock in their rate for the next 30 years. And just as many banking institutions have unpleasantly discovered, investor demand for mortgage bonds that have locked interest rates in the 2% to 2.5% range is relatively low in an environment where inflation and mortgage rates have moved meaningfully above these levels.

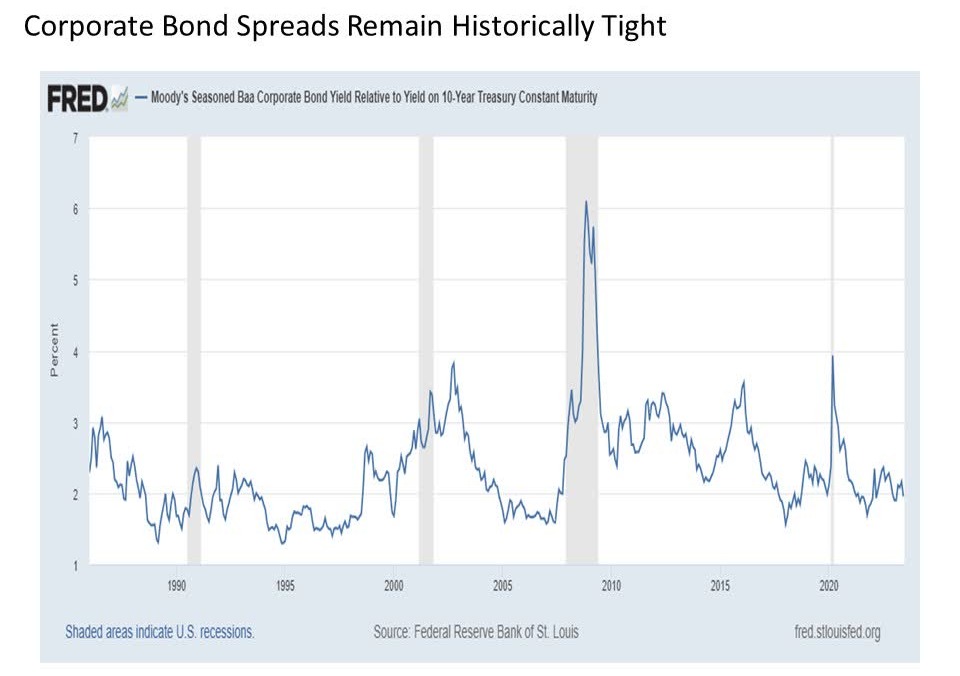

Spread too thin. But what about investment grade (IG) corporates? After all, investors have historically been well compensated for the yield premium they have received for taking on the additional liquidity and default risk of lending money to creditworthy corporate borrows. What about corporates in the current environment?

It is prudent to favor Treasuries over corporates in the current environment. The following are some key reasons.

First, the yield premium investors are receiving today for owning corporates remains thin relative to history. For example, the additional yield being paid to investors for owning corporate credits at the lowest rung of the IG credit rating spectrum in the BBB/Baa space is roughly 2%. This tight spread is not only below the long-term historical average, but also remains near the lowest levels seen in the post GFC period.

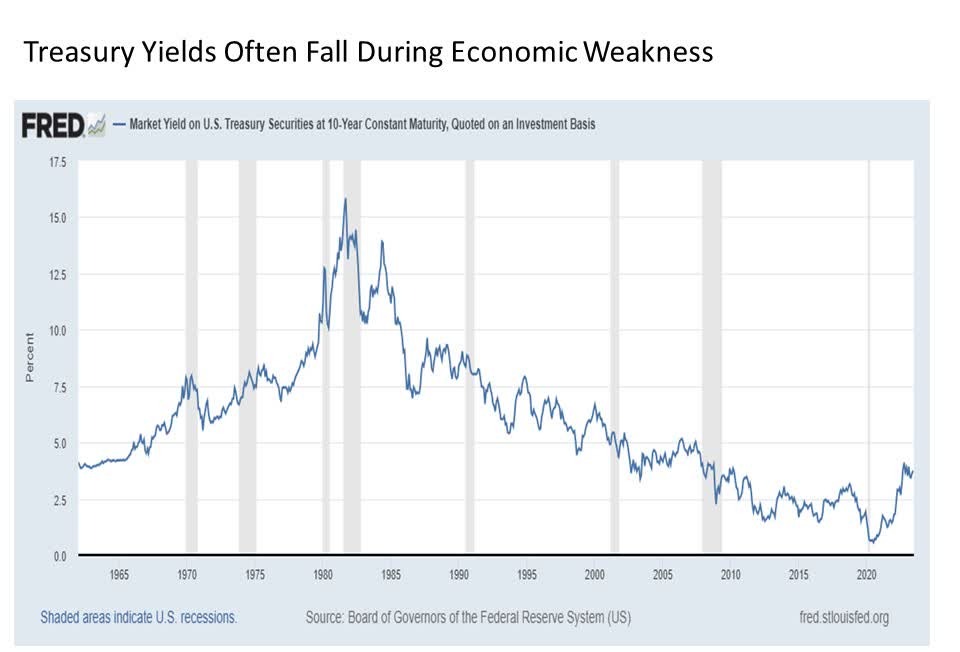

Next, for those investors that might still be inclined to take this relatively meager premium, they are likely still well served to opt for comparably dated Treasuries today instead. This is due to the fact that the probability for economic recession in the months ahead remains high. And when the economy has fallen into recession, IG corporate bond spreads have historically widened, in some cases dramatically depending on the length and/or magnitude of the economic slowdown. But even in the case of a mild recession, spreads have historically widened by as much as two percentage points or more. This means that Treasuries typically perform much better than IG corporates during periods of economic weakness. This often includes lower yields and positive returns from Treasuries versus higher yields and negative returns from IG corporates during the periods in and around recessions.

Bottom line. While 2022 brought a particularly difficult period for the bond market, the asset class is increasingly regaining its footing as we continue through 2023. And when considering an allocation within the bond market going forward, the environment favors Treasuries over corporates and mortgage backed securities.

Disclosure: Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.