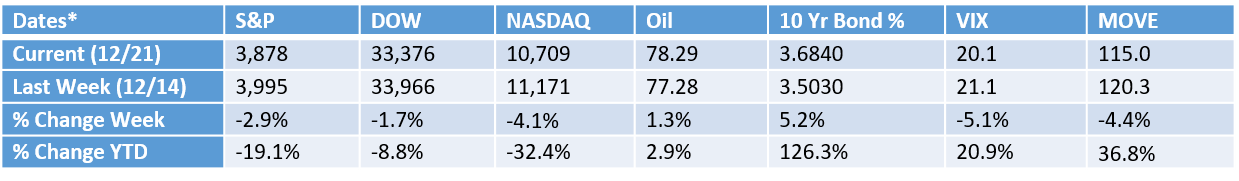

Happy Holidays to everyone and wishing you a very Merry Christmas and a Happy Hanukkah! The markets this week have continued to roll over and unfortunately, it does not look like we are going to have that classic Santa Claus rally. So in terms of thinking about the holidays and trying to add some holiday cheer, let’s look at this two ways:

-

- As the title of this note implies, “Jingle Bells” bring to mind a happy, momentous occasion we are in the midst of with the celebration of birth. A “rebirth” in a way.

- Then, on the other hand, “Market Bells” implies a forewarning of potential risk as the market looks ahead. Like a buoy in the fog ringing its bell because you can’t see ahead of yourself.

So, in a way we are at a crossroads right now with both sets of bells ringing. But at least both sets of bells are ringing right now and it’s just going to depend if those market bells ring less in favor of those jingle bells sounding brighter days ahead. Only time will tell but I am hopeful they will! However, we do need to acknowledge that both sets of bells are ringing just as loud right now because we still have a very hawkish Fed that continues to say the course, along with the war and questions about China reopening. BUT we can also see potential calming if and when rate hikes subside and we get balance back, especially in the supply chain. And of course, if we get resolution with the war and China reopening.

Simply put, we are in an environment right now where questions still remain. So, as investors, this leaves us with some decisions to make as we look ahead to 2023. At this point, we are holding the defensive and quality theme we have had in the GVA models all year and by year-end, we will rebalance them again to that end. We are also going to trim some of the energy exposure in favor of the defensive healthcare sector and in fixed income, we will sell off our exposure to high yield in favor of core bonds. Dividends are also on the table for added exposure to the quality theme. We are also looking farther ahead into 2023 to navigate a potential shift in market sentiment if and when those jingle bells ring loud.

We are looking forward to 2023 as much as you are. But for now, we all hope you have a very Merry Christmas and a Happy Hanukkah! And most importantly that you are able to spend as much time with your family and friends celebrating this special time of year.

We will be back at it next week on the final four trading days of the year to get the Q4 rebalance done.

Take care!

*All data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Tracking# 1-05353197