Investing is a long-term game. And when evaluating long-term portfolio opportunities, it is worthwhile to consider the relative performance of various segments relative to the broader market. For over long-term periods of time, market gravity has an uncanny way of dragging relative outperformers back to earth and lifting relative underperformers to eventual new heights. Thus, seeking out those segments that have chronically underperformed for an extended period can bring rewards over time for those investors with a long-term focus.

Gravity. History has shown that various stock segments move in and out of favor relative to the broader market over time. Consider the information technology sector. Left for dead for years in the aftermath of the bursting of the dot.com bubble at the turn of the millennium, the tech sector roared back to life in the wake of the Great Financial Crisis in the 2010s and into the early 2020s. The underlying economic and policy environment was particularly ideal for mega cap tech stocks during this time period, as the combination of chronically sluggish economic growth, persistently low inflation, and easy monetary policy led many investors to seek out these big free cash flow generating growth companies at any price (plug a 0% interest rate into your discounted cash flow model and one can twist themselves to justify just about any premium valuation). This helped lead to an unprecedentedly long period of consistent outperformance of the tech sector relative to the broader market.

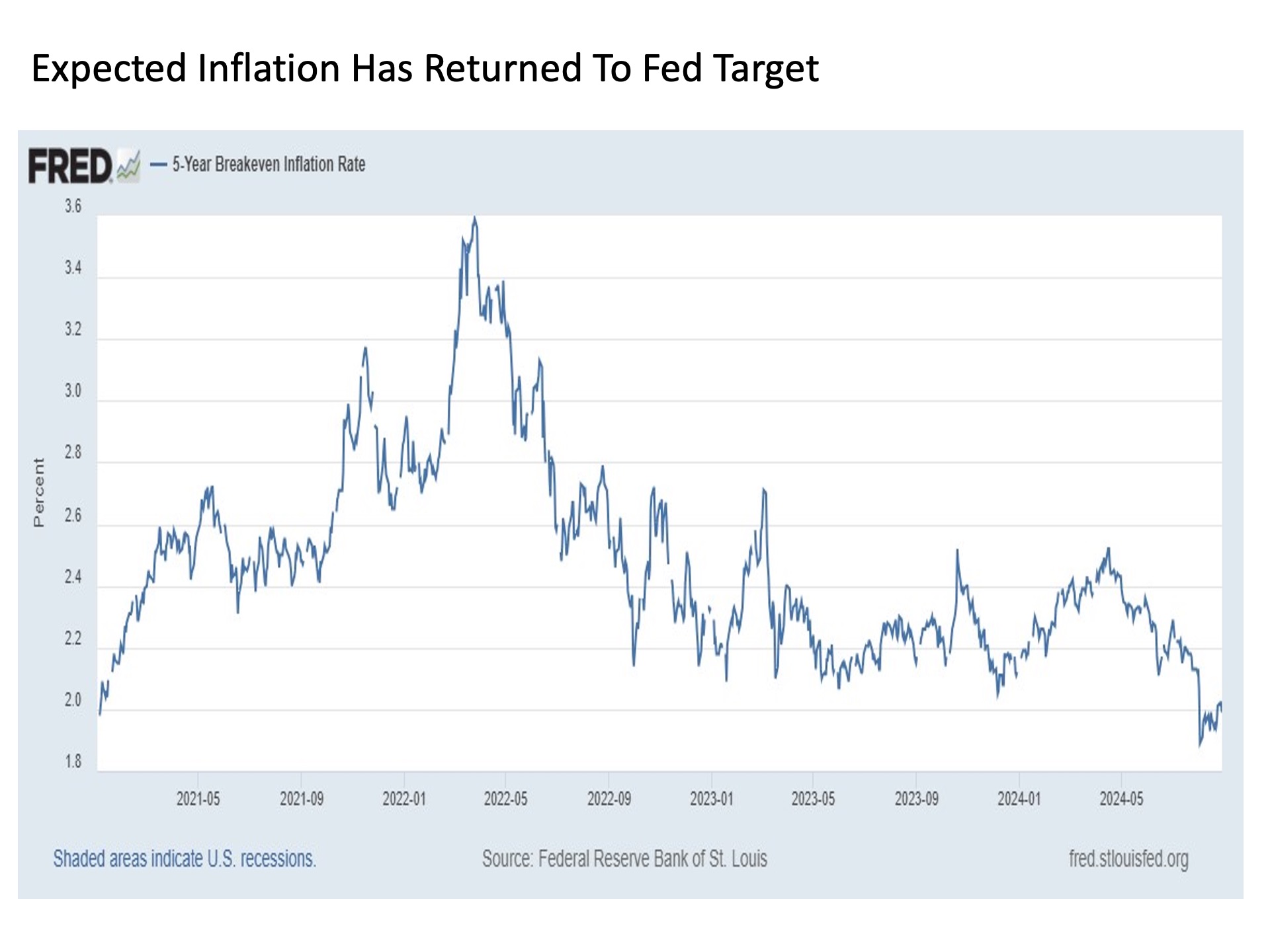

But here’s the problem for the white-hot tech sector going forward. Starting in 2022, the economic and policy environment changed dramatically. Instead, we are now in an environment of persistently solid but lately fading economic growth, the ongoing threat of a renewed inflation outbreak with pricing growth still running well ahead of the Fed’s long-term target, and a policy environment that recently turned easier from a monetary policy perspective but runs the risk of needing to tighten anew depending on how inflation pressures play out from here. These are all conditions that favor areas of the market other than tech shares, but apparently the sector may not have gotten the memo at least so far over the last two plus years.

The consumer discretionary sector may be foreshadowing the turn that could eventually befall the overdue tech sector. Since 2021, the consumer discretionary sector has descended into a relative decline versus the broader U.S. stock market.

The fact that tech adjacent Amazon and Tesla that together make up nearly 40% of the entire weighting in the sector have been essentially flat (Amazon) to solidly down (Tesla) over the past three plus years (doesn’t sound so magnificent, does it?) suggests that even the most optimistic stock high flyers eventually start to get pulled back to earth over prolonged periods.

Time and length. So if information technology is long overdue and consumer discretionary may have already peaked a few years ago now, what are the segments of the market that may warrant investor attention going forward? Fortunately, when so many stock market sectors get left behind for so long amid an extended technology sector boomlet, it means that so many sectors are trading at historically attractive valuations and deep discounts relative to the broader market.

Consider the consumer staples sector, which historically has thrived during periods of economic uncertainty while also providing a measure of inflation protection through the wide economic moats and pricing power that many of these companies boast. Today, consumer staples stocks are trading at their largest relative performance discounts in nearly 25 years, thus suggesting potential long-term opportunities.

A similar vein holds health care stocks. While they are not trading at the relative lows of its defensive consumer staples brethren, health care stocks have faded in the aftermath of the global pandemic to levels relative to the market last seen more than a decade ago.

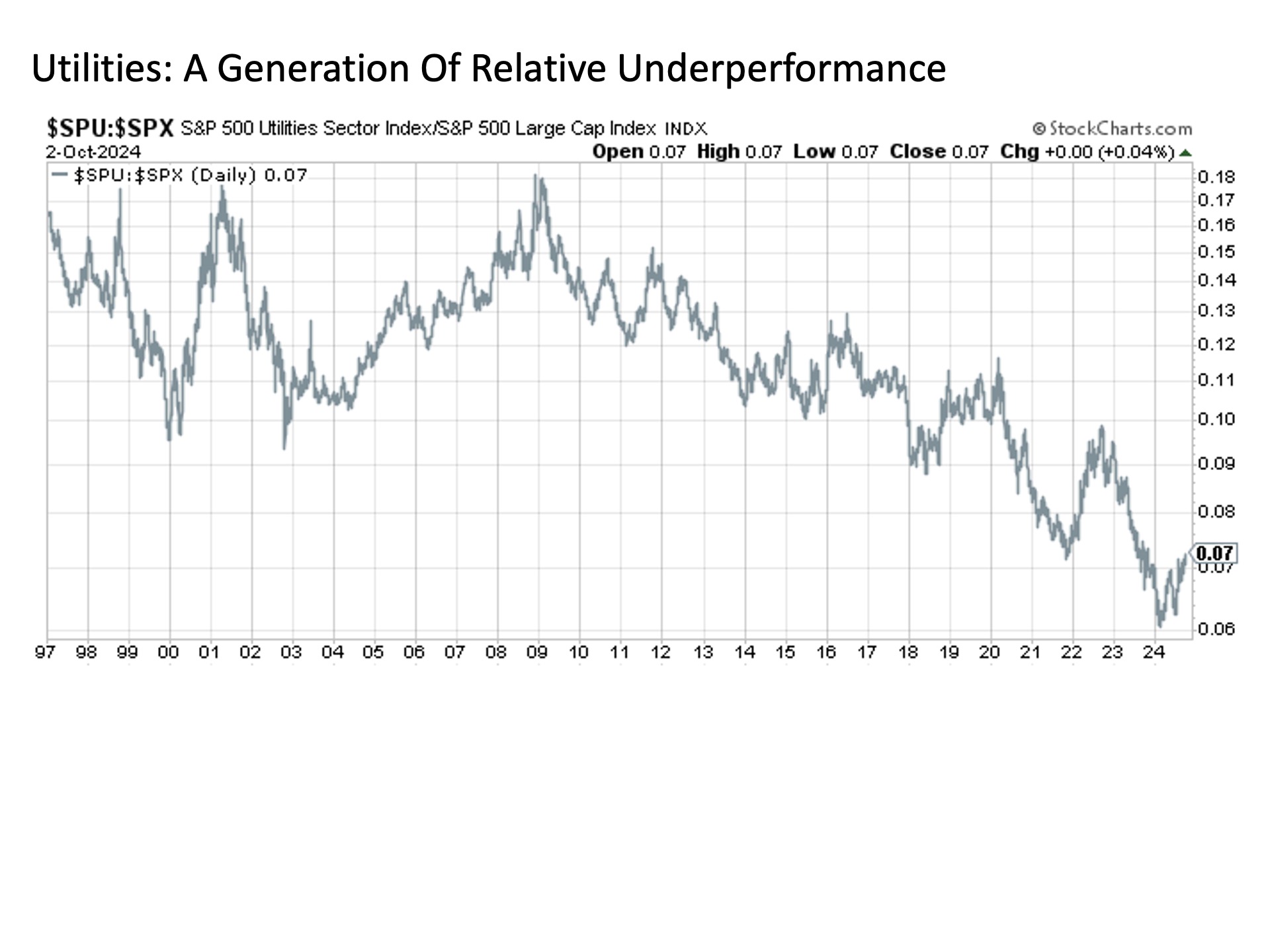

Rounding out the defensive trio is the utilities sector, which only recently bounced from historic relative pricing lows versus the broader S&P 500. While one could reasonably contend such a chronic relative decline may be irreversible for the likes of the old telecommunications services sector, the same cannot be said for electricity generation. To the contrary, the world is going need an awful lot of power well into the future to run all of the artificial intelligence technology that so many investors have been whipped up about these last couple of years.

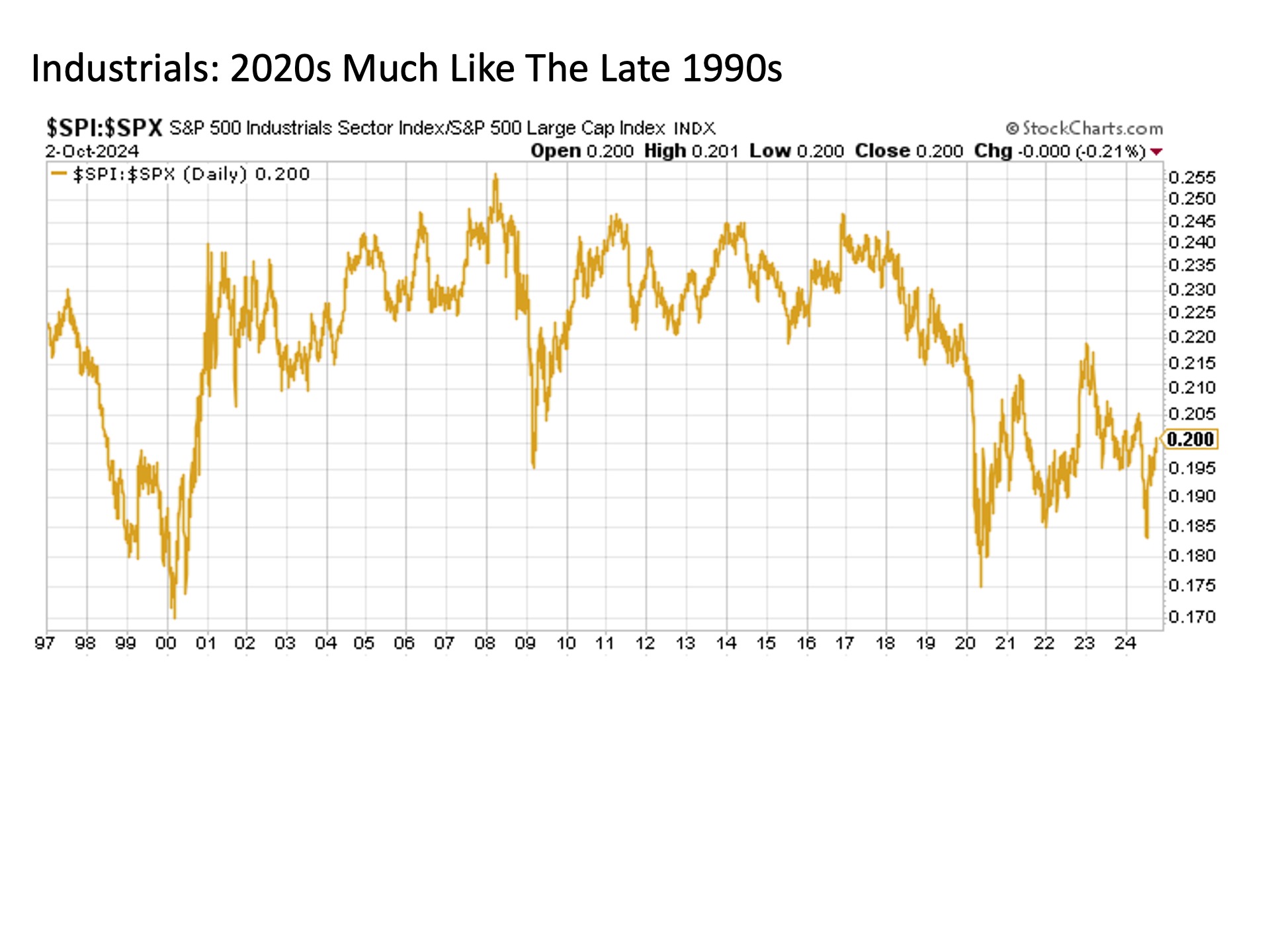

Defensive sectors are not the only ones trading at notable relative lows versus the broader market. Consider economically sensitive industrials, which have been trading at lows relative to the broader market for the last few years now that were last seen during the dot.com bubble a quarter of a century ago.

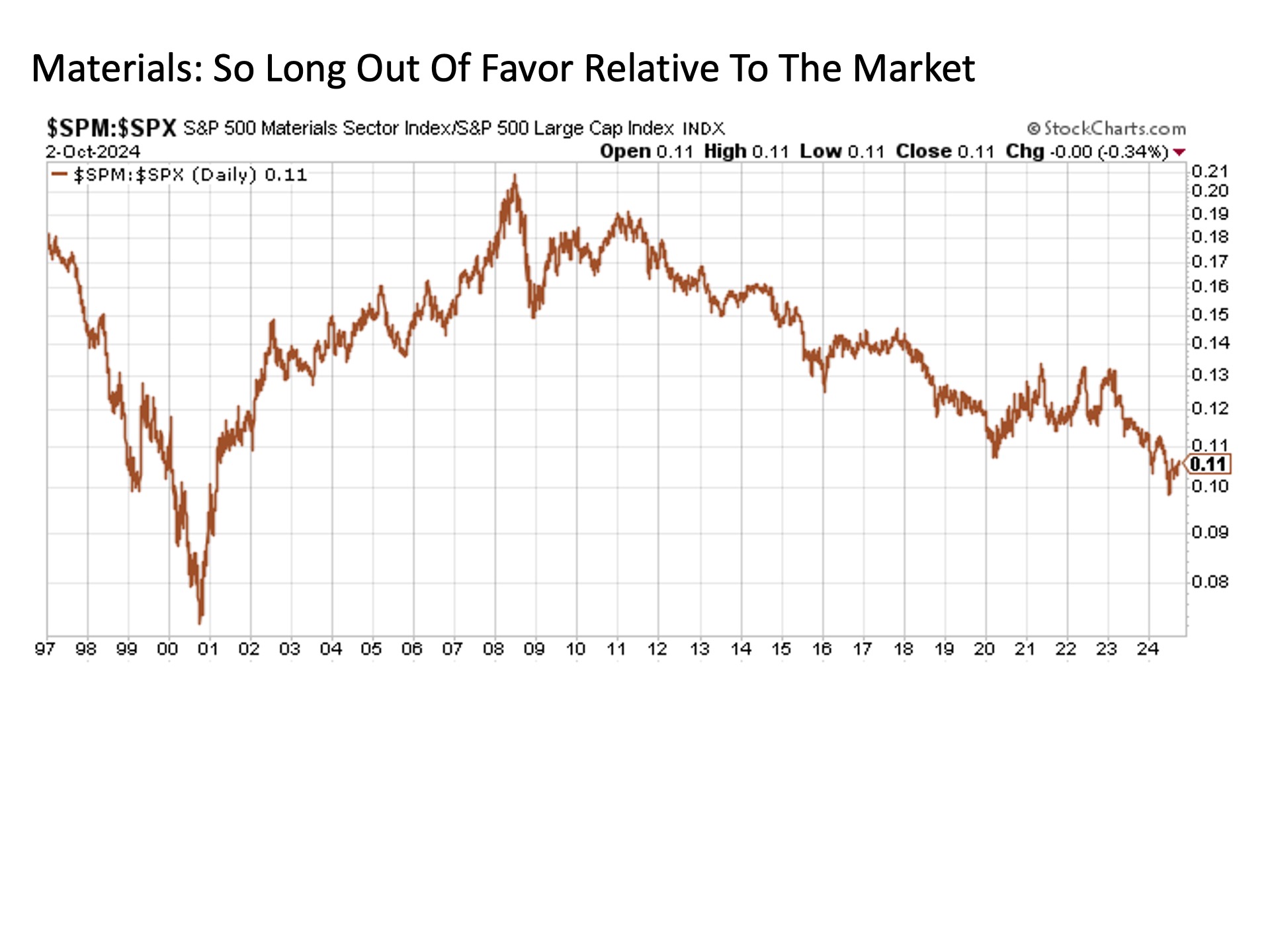

Then there is even more economically sensitive materials stocks, which have faded back toward dot.com era lows on a relative to the broader market basis ever since China got out of the commodities hoarding game not long after the calming of the Great Financial Crisis.

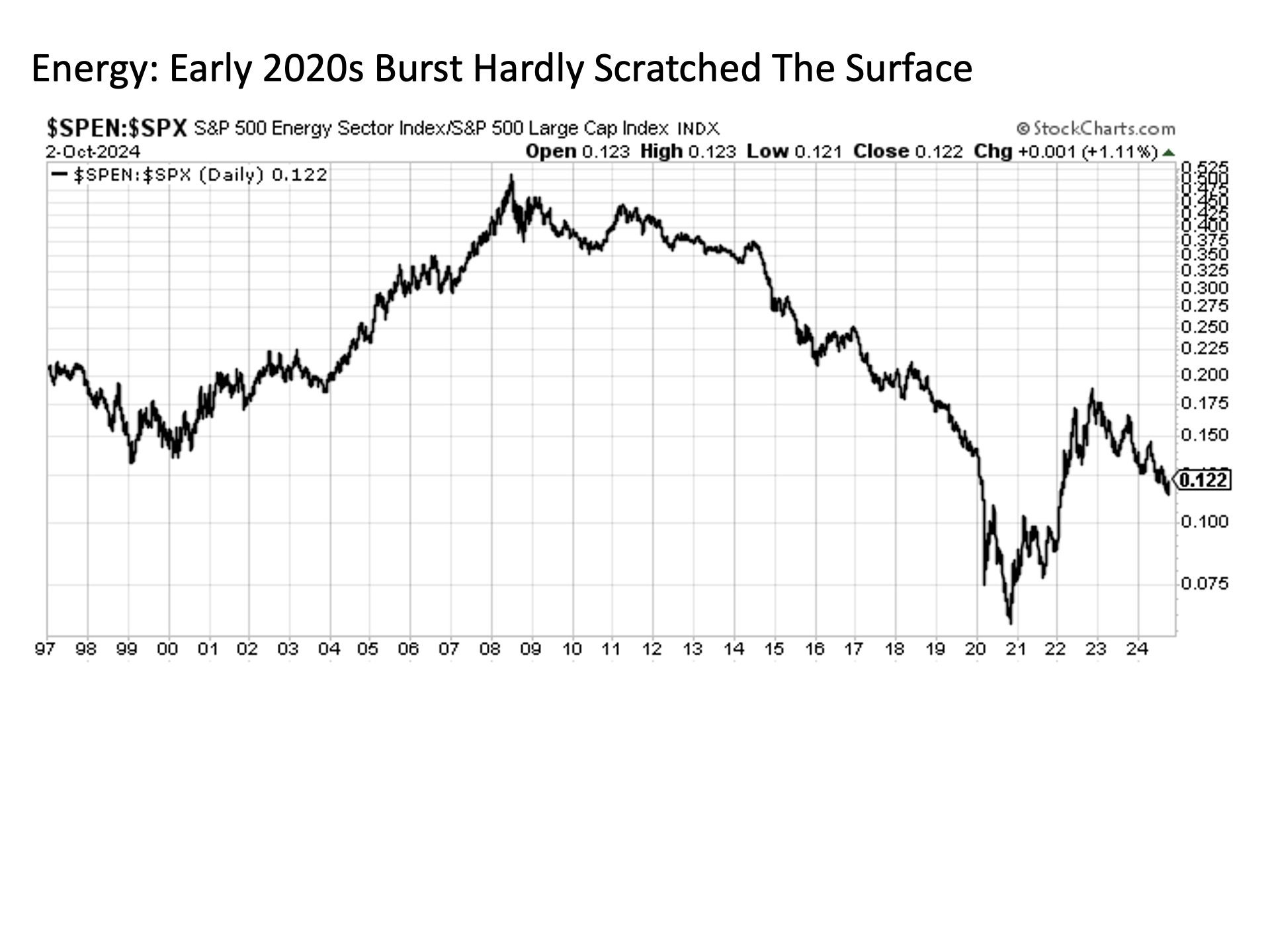

Lastly, we have the energy sector, that was pulled back like a slingshot relative to the broader market heading into the inflation outbreak earlier this decade. Although energy shares posted an impressive bounce, they have barely scratched the surface relative to the S&P 500.

Bottom line. While maintaining an allocation to segments that continue to perform well relative to the broader market is certainly warranted, those with a long-term time horizon may find more attractive investment opportunities by focusing on areas of the market that have been out of favor for an extended period, as history has shown that gravity more often than not pulls both winners and losers back to the center if not beyond.

I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

Compliance Tracking #: 640188-1